FATCA questionnaire in Due Diligence stage

The FATCA questionnaire is encapsulated in a KYC Type available in Due Diligence stage.

For a customer being an individual, the questionnaire is composed of a maximum of four item groups, which are displayed based on answers given:

- FATCA status

- Citizenship and residency

- Tax certification form

- U.S. indicia

For a customer being an entity, the questionnaire is composed of a maximum of four item groups, which are displayed based on answers given:

- FATCA status

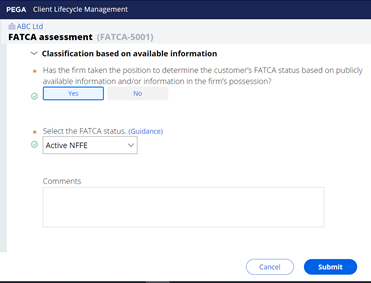

- Classification based on available information

- Tax certification form

- Classification based on tax certification form

‘FATCA status’ is pre-populated based on the input of the other item groups – hence it is read-only – and it provides the user with the overview of the outcome of the FATCA analysis, which is often used for reporting purposes.

‘Tax certification form’ is where the user indicates the type of form received, performs an assessment on its validity and, if applicable, enters the U.S. TIN of the customer.

If the customer is an individual, ‘Citizenship and residency’ is the section where the user will assess whether the customer is to be considered a US taxpayer in virtue of either citizenship or residency, while ‘U.S. indicia’ is the section where the user will assess possible indicators that the customer has some affiliation to the United States of America, e.g., country of birth or mailing address.

If the customer is an entity, ‘Classification based on available information’ is where the user can indicate the FATCA classification whenever it is possible not to collect the relevant tax form from the customer.

In the ‘Classification based on tax certification form’ section, the user will enter the Chapter 3 Status of the customer and the FATCA classification, plus additional information relevant to some of these tax classifications.

When the customer is classified as either “Owner Documented FFI” or “Passive NFFE”, then additional mandatory fields get displayed to capture identification details of the Specified US Persons/Substantial US Owners, if any, as well as their U.S. TIN.

Previous topic Regulatory details in Enrich stage