Financial Services Industry Foundation data model

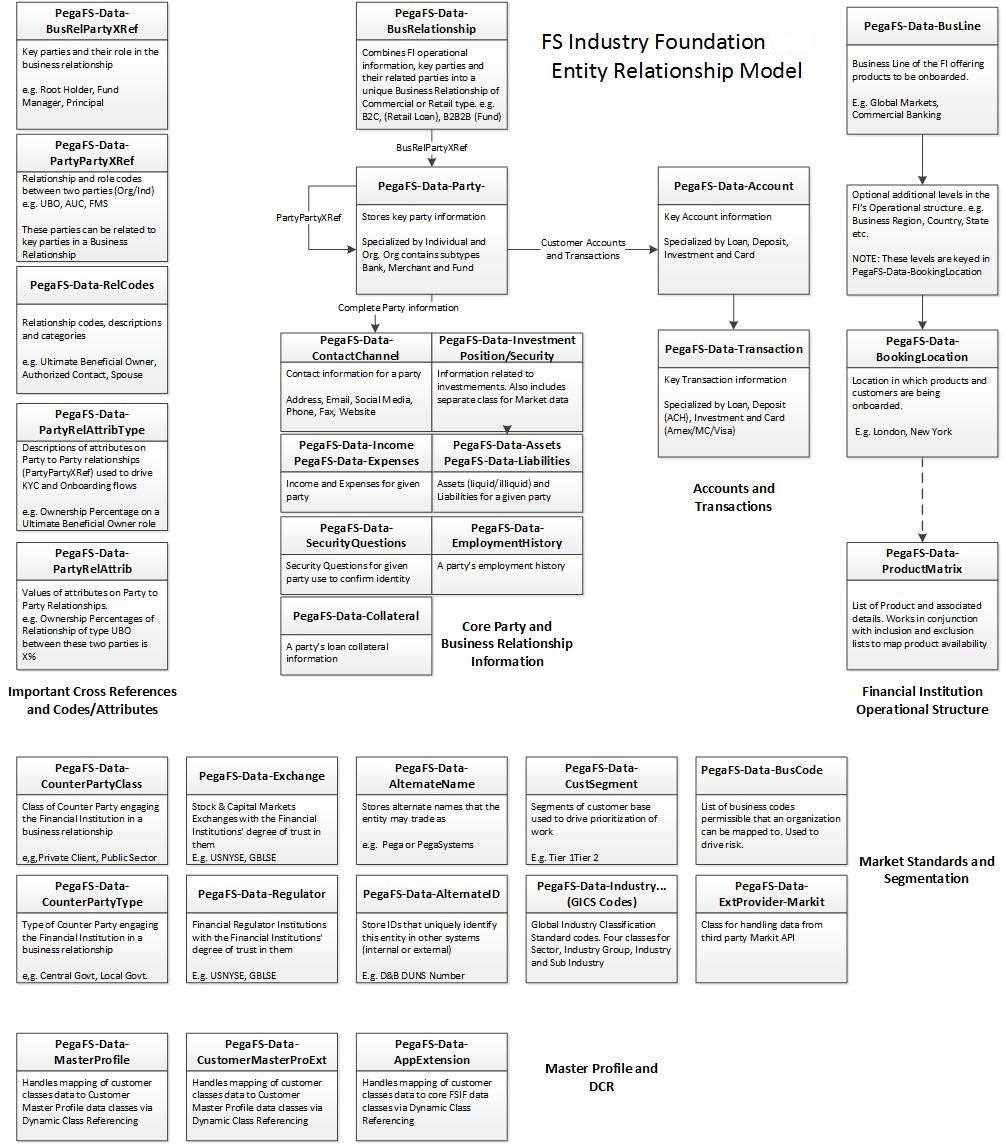

The Financial Services Industry Foundation (FSIF) data model is a set of classes that represent data that is commonly used by Financial Services applications. Applications should use these data model classes directly. The integration layer manages how data is stored and received.

The Financial Services Industry Foundation contains the following classes.

- Parties

- Households

- Accounts

- Beneficiaries

- Products

- Transactions

- Investment positions

- Assets and liabilities

- Identification verification

- Counterparty class

- Counterparty type

- Financial regulator

- Stock and capital markets exchanges

- Alternate name

- Alternate ID

- Customer segment

- Global industry classification standard codes

- Business codes

- Markit data

- Country

- Master profile

- Product matrix

Parties (PegaFS-Data-Party)

A party represents a person or organization that is associated with a case. PegaFS-Data-Party contains information that is common to all parties, such as email addresses, phone numbers, and tax IDs. PegaFS-Data-Party has two subclasses:

- Individual (PegaFS-Data-Party-Ind) – Represents an individual person. Contains properties to store information, such as first and last name, age, gender, and employment history.

- Organization (PegaFS-Data-Party-Org) – Models an organization (for example, a company). Contains properties that represent organization-specific information, such as industry, revenue, and managed assets.

- Fund (PegaFS-Data-Party-Org-Fund) – Contains properties that represent fund-specific information.

- Bank (PegaFS-Data-Party-Org-Bank) – Contains properties that represent bank-specific information.

- Merchant (PegaFS-Data-Party-Org-Merchant) – Contains properties that represent merchant-specific information.

Hierarchical relationships between parties can be represented using the PegaFS-Data-PartyPartyXRef class. This class is used to establish and classify parent-child relationships between parties. A party can have multiple parents and multiple children associated with it. The set of available relationships and codes that can be assigned resides in PegaFS-Data-RelCodes.

Attributes in specific relationships can be handled using the PegaFS-Data-PartyRelAttribType and PegaFS-Data-PartyRelAttrib. For example, the role of Ultimate Beneficial Owner for an organization can have an attribute of Ownership Percentage. A percentage value can be stored against that attribute to help drive onboarding and due-diligence activity.

- PartyFS-Data-PartyPartyXRef replaced PartyFS-Data-CustCustXRef and PartyFS-Data-HouseholdXCustRef.

- PartyFS-Data-Relcodes replaced PegaFS-Data-AcctRelCodes.

Suggested field values exist for potential types of address and communication categories, and are implemented in the UI to help normalize input data (for example, Work Phone, Legal Fax, and so on). These types differ between commercial and retail, and any existing data has been mapped accordingly.

Households (PegaFS-Data-Household)

This class enables you to group parties together into a logical household where each party has a specific role associated with it. The household class can represent aggregated assets and liabilities of the household members that are part of a family unit. It can also represent external entities, such as attorneys, who have an interest in the household but do not own assets within the household. A household can contain many parties and a party can be a member of many households.

Relationships between parties and households are defined in the PegaFS-Data-PartyPartyXRef class.

Accounts (PegaFS-Data-Account)

Financial Services Industry Foundation contains a number of classes that represent data associated with a variety of different financial services accounts. The base account class is PegaFS-Data-Account. It contains properties common to all accounts, such as the account number, balance, owner, and open date.

You can extend this class to model any type of financial service account. Financial Services Industry Foundation currently provides implementations for the following account types:

- Investment Account (PegaFS-Data-Account-Investment) – Contain information on securities and other investment assets that are held by the account holder.

- Credit Card Account (PegaFS-Data-Account-Card) – Models an account associated with a credit card. In addition to the usual account information inherited from the base account class, it contains properties that describe relevant information, such as annual fee amounts, balance transfers, disputes, and the base currency of the account.

- Loan Account (PegaFS-Data-Account-Loan) – Contains information related to an outstanding loan. It has properties that represent loan-specific information, such as the type of loan, amount, rate, interest, and account delinquency.

- Deposit Account (PegaFS-Data-Account-Deposit) – Any account that allows funds to be deposited and withdrawn. Examples of deposit accounts are checking and savings accounts.

- Credit card details (PegaFS-Data-CardDetails) – Information that includes credit card number, security code, and expiration date

Accounts are frequently associated with other entities, such as Products and Customers. These relationships are complex because they can be one-to-one, one-to-many, or many-to-many. When a many relationship exists, a separate class is available to represent these relationships:

- Customer/Account cross-reference (PegaFS-Data-AcctXRef) – Represents the relationship between a customer and an account. Note that it is possible to have more than one account associated with a customer as well as to have multiple customers associated with a single account. This class enables you to establish many-to-many relationships between customers and accounts. Note that this relationship works with all of the account types.

- Account/Product cross-reference (PegaFS-Data-AcctProdXRef) – Provides a method of associating accounts with products. A single account can have multiple products associated with it.

- Account/Product/User cross-reference (PegaFS-Data-AcctProdUserXRef) – Represents the set of products that are associated with an account on which a given user is authorized. An account can have multiple products associated with it, and each product can have multiple users who have authorization within a product. A user can be authorized on many products across many accounts.

- Multiple Card Support (PegaFS-Data-AcctCardXRef) – Supports one or more cards for an account. A cross-reference data class links accounts to one or multiple cards (debit or credit).

- A debit card is always tied to a deposit account, and a credit card is tied to another credit card as an add-on card.

- In case of multiple credit cards, the AccountNumber of PegaFS-Data-Account- and CardNumber of PegaFS-Data-AcctCardXRef is the same for primary card holder but is different for any add-on cards.

- Transactions are retrieved from the database and are mapped to PegaFS-Data-Transaction-Deposit or PegaFS-Data-Transaction-Card.

- The ability to filter the transactions by Deposit Account or Individual Cards is provided as part of the implementation.

- Account address cross-reference (PegaFS-Data-AccAddressXref) – Represents the relationship between an address and an account.

Beneficiaries (PegaFS-Data-Beneficiary)

Some types of accounts can have one or more beneficiaries associated with them. Beneficiaries are represented by the PegaFS-Data-Beneficiary class, which contains information on the relationship and allocation amount of a beneficiary.

Products (PegaFS-Data-ProductMatrix)

Accounts can have products associated with them. Products are features that are enabled on an account, and are related to both accounts and authorized users.

Transactions (PegaFS-Data-Transaction)

Transaction classes inherit from the abstract base class PegaFS-Data-Transaction. A transaction is always associated with a single account. This class provides core properties that apply to all transactions, such as the account number, transaction amount, and date of the transaction.

Financial Services Industry Foundation supports the following classes that inherit from PegaFS-Data-Transaction:

- Investment Transaction (PegaFS-Data-Transaction-Investment) – The representation of an investment transaction. It adds properties, such as the security ID, transaction price, and quantity.

- Credit Card Transaction (PegaFS-Data-Transaction-Card) – Adds a variety of information that is specific to credit cards, such as acquirer, merchant, and a property used for flagging a transaction as potentially fraudulent. Contains three subclasses, each representing a specific type of credit card:

- MasterCard Transaction (PegaFS-Data-Transaction-Card-MC)

- American Express Transaction (PegaFS-Data-Transaction-Card-AMEX)

- Visa Transaction (PegaFS-Data-Transaction-Card-Visa)

Merchant information is contained in the PegaFS-Data-Party-Org-Merchant class. This class represents a select amount of information related to the merchant who processed the credit card transaction.

- Loan Transaction (PegaFS-Data-Transaction-Loan) – Represent payments made on existing loans.

- Deposit Transaction (PegaFS-Data-Transaction-Deposit) – Represent normal bank account deposits and withdrawals.

- Automated Clearing House (ACH) Transaction (PegaFS-Data-Transaction-Deposit-ACH) – Transactions that are typically scheduled and batched. These transactions include direct deposit payroll and vendor payments, all of which can be credited to or debited from deposit accounts.

Investment positions (PegaFS-Data-InvestmentPosition)

Capital market investments are represented by the PegaFS-Data-InvestmentPosition class. This class models portfolio position data including the security held, number of shares, cost basis, and currency.

The securities are defined by the PegaFS-Data-InvestmentSecurity class. This class represents data associated with securities, such as the security name, ticker symbol, and the exchange on which it is traded.

Assets, liabilities, income, and rent

The Financial Services Industry Foundation data model provides classes that represent the various types of assets and liabilities that are associated with a customer. The following classes describe this information.

- Liquid Assets (PegaFS-Data-Asset-LiquidAsset) – Assets that can be sold rapidly with minimal loss in value, such as funds located in a savings account. This class models these assets with properties, such as asset name, type, and amount.

- Illiquid Assets (PegaFS-Data-Asset-IlliquidAsset) – Assets that are not readily available to be converted into cash due to uncertainty about sale price or the availability of a market to sell the asset. An example of an illiquid asset is a large block of stock, because the share price is variable and could fluctuate downward without notice. A car is also an example of an illiquid asset, because it might not be possible to find a buyer on short notice.

- Liabilities (PegaFS-Data-Liabilities) – Financial obligations that represent funds owed to another party. The liability class contains properties, such as the type and amount of the liability, as well as information relating to how the liability is paid back.

- Income (PegaFS-Data-Income) – References assets and liabilities, for example, income from apartment rentals.

- Expenses (PegaFS-Data-Expenses) – References assets and liabilities, for example, paying rent.

Identification verification (PegaFS-Data-IDVerification)

Financial Services Industry Foundation provides a class for representing government documents that identify a party. Examples of these documents include birth certificates, driver's licenses, passports, and green cards.

Counterparty class (PegaFS-Data-CounterPartyClass)

When a customer establishes a trading business relationship with a financial institution, that customer becomes a counterparty for the financial institution. This class handles the necessary properties used to categorize the class of counterparty that the customer becomes (for example, Bank, Exchange Broker).

Counterparty type (PegaFS-Data-CounterPartyType)

When a customer establishes a trading business relationship with a Financial Institution, that Customer becomes a counterparty for the Financial Institution. This class handles the necessary properties used to categorize the type of counterparty that the customer becomes (for example, Central Government, Local Government, Private Customers).

Financial regulator (PegaFS-Data-Regulator)

This class contains properties for worldwide financial regulator institutions if they are approved by the financial institution. Example approved exchanges include:

- Australia Stock Exchange (ASE)

- Nicaragua - Nicaragua Stock (NISE)

Stock and capital markets exchanges (PegaFS-Data-Exchange)

This class contains properties for worldwide stock and capital markets exchanges if they are approved by the financial institution. Example approved regulators include:

- Bank de France (BDG)

- Cayman Islands - Cayman Islands Monetary Authority (CIMA)

Alternate name (PegaFS-Data-AlternateName)

This class handles a list of alternate names that are permissible for the organization. Example organizations and alternate names include:

- Pegasystems, Pega

- IBM, International Business Machines

Alternate ID (PegaFS-Data-AlternateID)

This class contains a list of Identification numbers that are used for recognizing an organization in other systems, for example, Markit ID, DUNS numbers, and internal App ID.

Customer segment (PegaFS-Data-CustSegment)

This class allows the customer base to be split into different segments and is used to drive prioritization of work. Different lines of business can have different customer segmentation. Example segments include:

- Corporate and Investment Banking: Tier 1, Tier 2, Tier 3

- Retail banking: Platinum, Gold, Silver

Global industry classification standard codes (PegaFS-Data-GICS)

Global industry classification standard codes are a four-part set of codes that are used to categorize organizations. They can be used to drive business processes, such as perceived risk for onboarding a customer. The four levels are described as follows:

- Sector (for example, Industrials)

- Industry Group (for example, Capital Goods)

- Industry (for example, Electrical Equipment)

- Sub-industry (for example, Heavy Electrical Equipment)

Business codes (PegaFS-Data-BusCode)

This class contains a list of business codes to which an organization can be mapped. Business codes are used in conjunction with other information, such as sub-industry, country of incorporation, and counterparty type, to flag vulnerable business activities.

Markit data (PegaFS-Data-ExtProvider-Markit)

This class contains data and documents about organizations that is returned from the Markit third-party API. The data and documents are used during customer onboarding and due diligence.

Country (PegaFS-Data-Country), province-state (PegaFS-Data-ProvinceState)

The standard country data provided with the Pega 7 Platform has been supplemented to provide and track more information for each country, for example, Organization for Economic Co-Operation and Development (OECD) membership, European Union (EU) membership, Intergovernmental Agreement (IGA) status, sanction status, and reason for sanction and sensitivity. The province/state table provides data about a province or state within a country.

Master profile (PegaFS-Data-Party-MasterProfile)

The master profile data object provides easy access to core customer data that is required to process work. By persisting this customer data directly in the work object, it provides:

- Higher performance without directly accessing the system of record for every transaction

- Synchronization with underlying systems of record as needed

- Access to a customer risk profile driven by Pega’s decisioning technology and available customer data

The following data elements are provided in the master profile:

- Single properties:

- CustomerID(Text)

- ShortName(Text)

- FullName(Text)

- CustomerType(Text)

- CustomerSubtype(Text)

- CustomerStatus(Text)

- CountryOfInc (Text)

- CountryOfBirth(Text)

- CountryOfDomicile(Text)

- CountryOfNationality(Text)

- SubIndustryID(Text)

- BusinessCode(Text)

- CustRiskCode(Text)

- CustomerNextReviewDate (Date)

- CustomerSince(Date)

- List of customer business countries

- Property BusinessCountryList of type PageValueList, of class PegaFS-Data-Country

- List of customer alternate names

- Property AlternateNameList of type PageValueList, of class PegaFS-Data-AlternateName

- List of customer alternate IDs

- Property AlternateIDList of type PageValueList, of class PegaFS-Data-AlternateID

- Customer unified document check-list:

- Property UnifiedDocCheckList of type PageList, of class PegaFS-Data-DocCheckList

- Customer risk profile:

- Property RiskProfile of type Page, of class for the PegaFS-Data-RiskProfile

- List of relevant related parties (subsidiaries, ultimate beneficial owners [UBOs], and so on)

- Property RelevantRelationshipList of type PageList, of class PegaFS-Data-PartyPartyXRef

- Customer business relationships (products/locations):

- Property BusinessRelationshipList of type PageList, of class PegaFS-Data-BusRelationship

Data exposed as part of the master profile - Page List and Page List Value properties

- Index-PegaFS-Data-BusRelationship:

- Declare Index rule in PegaFS-Data-Party-MasterProfile BusRelationshipsOnMasterProfile

- Cloned Declare Index rule in PegaCLMFS-Data-Party-MasterProfile BusRelationshipsOnMasterProfile

- Dedicated table

- Exposing key data for the Customer Business Relationship

- UniqueIdentifier

- BusRelId

- BusRelType

- FIOrganisation

- Name

- Status

- StatusChangeDate

- ValidStartDate

- ValidEndDate

- Index-PegaFS-Data-ProductAdoption:

- Declare Index rule in PegaFS-Data-Party-MasterProfile ProductAdoptionOnMasterProfile

- Cloned Declare Index rule in PegaCLMFS-Data-Party-MasterProfile ProductAdoptionOnMasterProfile

- Dedicated table

- Exposing key data for the products to be adopted by the customer as part of their business relationships:

- BookingLocation

- JurisdictionCode

- ProductId

- ProductName

- Status

- StatusChangeDate

- ValidStartDate

- ValidEndDate

- Index-PegaFS-Data-BusRelPartyList:

- Declare Index rule in PegaFS-Data-Party-MasterProfile BusRelPartyListOnMasterProfile

- Cloned Declare Index rule in PegaCLMFS-Data-Party-MasterProfile BusRelPartyListOnMasterProfile

- Dedicated table

- Exposing key data for the parties to be involved as part of the customer business relationships

- PartyId

- BusRelCodeType

- BusRelCodeDesc

- ValidStartDate

- ValidEndDate

Product matrix (PegaFS-Data-ProductMatrix)

The Financial Services Industry Foundation data model provides classes that represent the list of products that are available in the system. The availability of products is tied to the operational structure and the location of the operator within the operational structure.

In addition to the location of the operator, the availability of products uses inclusion and exclusion cross-reference tables to configure products that can be eliminated from an operator’s location as exceptions either through line of business, product ID, jurisdiction, or booking location.

Previous topic Pega Foundation for Financial Services Next topic Event-driven architecture