Setting up accounting cutoff

Smart Investigate for Payments supports the use of warning and cutoff times for accounting transactions which enables your organization to run end-of-day accounting feeds and reports on reconciliation and balances.

When Smart Investigate for Payments is installed, accounting cutoff is not enabled. It is set up to bypass the evaluation of cutoff times for all accounting entries — enabling round-the-clock processing of your outgoing debits and credits. This is configured by referencing a cutoff rule named Default in all of the payment types shipped with the product. This rule references a special instance of Data-Admin-Calendar called AcctCutoff that has all days of the year set to business days.

If you want to enable accounting cutoff for your organization, follow the setup instructions below.

You can use multiple cutoff rules to differentiate different accounting extraction and feed schedules.

Cutoff can be activated in two modes: Standard and Future.

- Standard —You or Smart Investigate for Payments can continue researching and processing cases but the standard cutoff prevents accounting transactions from posting until a specified release time is reached. In most instances, work on the case can continue until a workflow or transaction point is reached where processing cannot advance until the transaction is posted. Installed, this is the default cutoff mode.

- Future —You or Smart Investigate for Payments can continue researching and processing cases and continue posting transactions after the day’s cutoff has been reached. When processing in this cutoff mode, debit and credit transactions in the step are posted to the accounting posting file with the next business day’s date and a time of 00:05:00 so it posts normally on the next business day. This means the accounting feed must be extracted by date ignoring the time stamp. The online display shows date and time as entered in the posting file so you know what was done between cutoff and the next business day. This method also works well for weekend processing.

Referenced by:

- Payment Types used in the accounting step rules

- Accounting displays that identify entries held for cutoff

- Online indicators that identify entries that passed warning or cutoff times

Format:

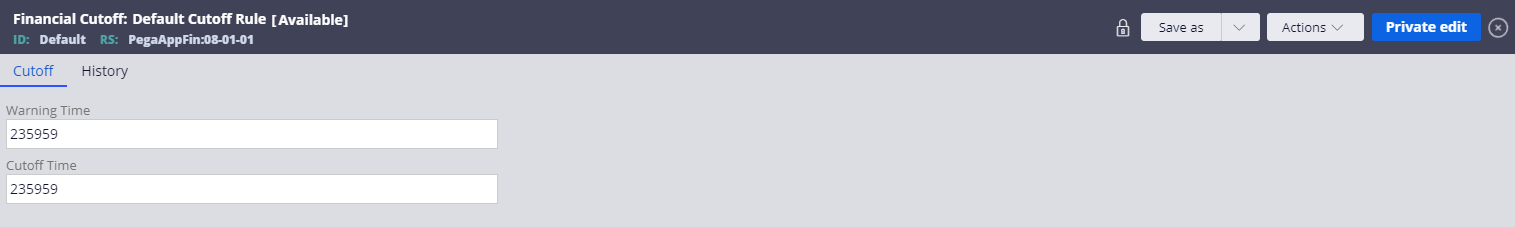

- Time —set in 24-hour notation format of hhmmss

- Naming scheme —should describe the accounting deadline (for example, DDA or General Ledger)

Ruleset records affected:

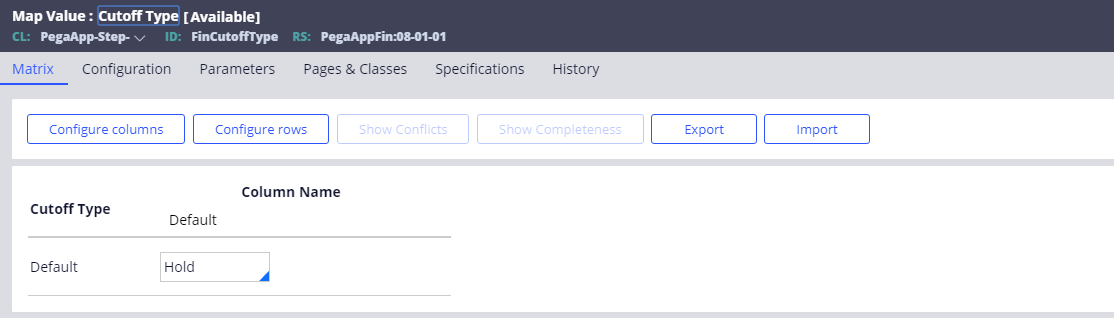

- Rule-Obj-MapValue named CutoffType —defines the type of cutoff; defaults to Hold for Standard mode, and update to Future for Future mode

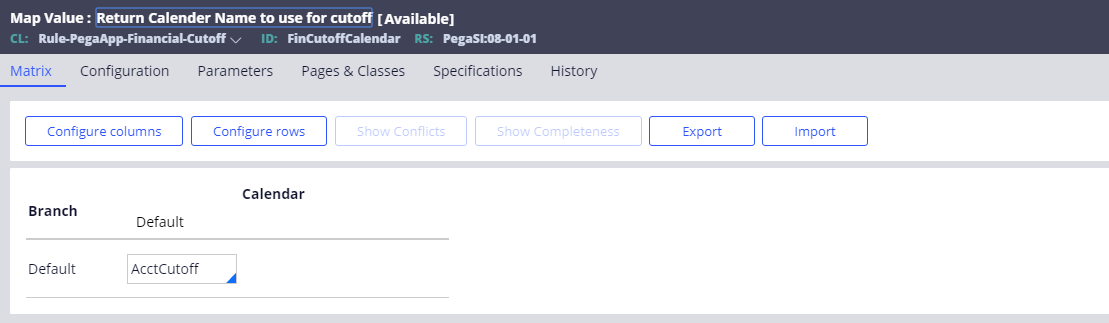

- Rule-Obj- MapValue named CutoffCalendar —defines which calendar to reference for work dates

- Rule-PegaApp-Financial-Cutoff — defines the cutoff time, one instance for each cutoff schedule needed

The following figure shows an example of the cutoff type form.

The following shows an example of the cutoff calendar form used to select the calendar to use for cutoff.

The following shows an example of the cutoff calendar rule used to define the cutoff times.

Previous topic Setting up accounting verification levels Next topic Setting up accounting documents