Setting up accounting step rules

Smart Investigatefor Payments uses accounting rules to define the debit and credit entries for adjustment transactions supported by the workflows. Called accounting steps, these adjustment rules define a one-time accounting transaction that creates a balanced set of debit and credit account entries.

Accounting rulesshare the same class structure, including the key. The key consists of the class of the case for which the accounting is being processed, the accounting action, and a step descriptor or type.

When deploying Smart Investigate for Payments, you need to consider and update a number of data elements in the accounting step rules. See Appendix D, Application-Specific Information, for a list of the accounting step rules and associated payment types. To modify a step rule, first save it in your ruleset, and then update it. The updates typically include one or all of the following tasks:

- Add verification to a step

- Update the payment type

- Change account defaulting information to use different party roles

- Reference different internal accounts listed in your Chart of Accounts

Ruleset records affected:

- Rule-PegaApp-Financial-Adjustment Naming Conventions.

The name or key to the step rules is a concatenated string that describes of the type of adjustment it generates. For example:

- The name InternalAdjustment1DR2CR generates one debit and two credits.

- The name ReversalDR reverses a debit entry.

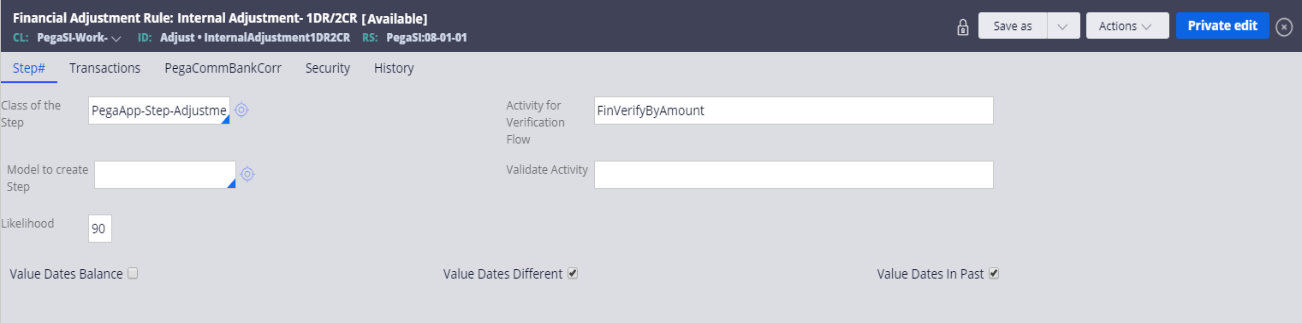

- The following shows the Step tab of the Adjustment Rule window for the instance PegaSI-Work-Adjust-InternalAdjustment1DR2CR

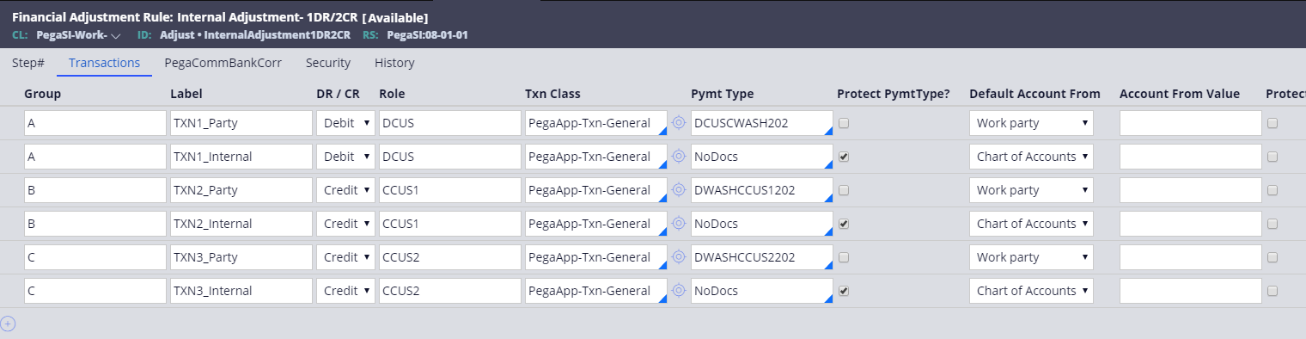

The image below shows the Transactionstab for the same instance; the screen is wide and you must scroll from left to right to see all the fields. These fields, and their use in creating new step rules, are described in detail below.

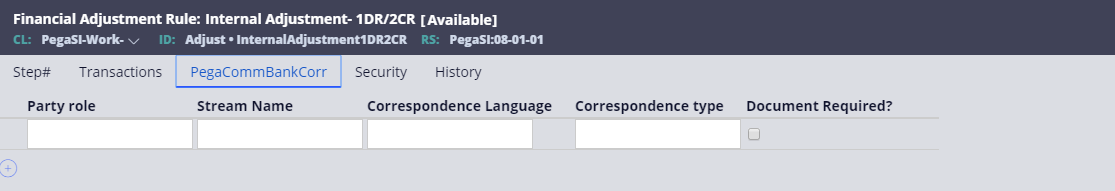

The following shows the PegaCommBankCorr tab for the same instance. These fields and their uses are described below.

| Field | Description |

| Short Description | Required. Short description ofthe step rule. The default is the instance name. |

| StepTab | |

| Class of the Step | The class of the page that holds the Step data. Specify a Rule-Obj-classname that is a concrete child class of PegaApp-Step-. |

| Activity for Verification Flow | An activity at the class of the step that calls a verification flow. If blank, the system automatically bypasses verification. One activity delivered with the product specifies a verification flow based on amount values. The system also has four verification flows (no verification required, one level, two levels, or three levels of verification required), which can be used based on the amount of the step. |

| Model to create Step | A rule of type Rule-Obj-Model at the class of the step. If specified, the system creates the step page based on the model. The step rules in the product do not use a model. |

| Validate Activity | Reserved for future use. |

| Likelihood | An integer between 0and 100 used to preselect the most likely step rule (the one with the highest number) during the manual flow actions that create accounting steps. The flow actions find all step rules that apply to the flow action. |

| Value Dates Balance | |

| Value Dates Different | If checked, you can use different value dates. |

| Value Dates In Past | If checked, you can use value dates in the past to calculate the accounting transaction. |

| Transactions Tab |

| Field | Description |

| Group | Specifies if this transaction is part of a group of transactions such that only one transaction in the group will be used when the accounting is created. In manual processing, the user selects which transaction from the group to choose (the Label property is displayed in a selection box so only one transaction can be chosen). In automatic processing, the first transaction in the group is selected, so the order is significant. |

| Label | This value appears in the window during manual accounting creation flow actions to indicate to the user what the transaction is. |

| DR /CR | Indicates if the transaction is a Debit or a Credit. The rule requires that debits are listed before credits for consistency, as the order of the transactions in the rule is the order in which they are displayed during manual accounting creation flow actions. |

| Role | A unique string identifier for each transaction in this step. Its value is placed into a property named Role in the transaction of the step, and can be used to find or report on the transaction. |

| TxnClass | The class of the page that holds the transaction data; specify a Rule-Obj-Class name that is a concrete child class of PegaApp-Txn-. |

| Pymt Type | Name of Rule-PegaApp-Financial-PaymentType rule to use for this transaction. The payment type rule associates correspondence with the transaction. |

| Protect PymtType? | If selected, the user interface during manual accounting creation does not allow input in the Pymt Type field. If not selected, users can modify this value during manual accounting creation. |

| Default Account From | Where to acquire the account name and number for this transaction:

|

| Account From Value | Specifies a party role if the Default Account From value is Party. Specifies an internal account name (as defined in the map value ChartOfAccts) if the Default Account From value is Chart of Accounts. |

| Protect Account? | If this field is selected, the user interface does not allow input in the Account Name or Number fields during manual accounting creation. If this field is not selected, users can modify these values during manual accounting creation. |

| Default Amount From | This specifies where to acquire the default amount value for this transaction:

|

| Amount FromValue | Specifies a property reference if DefaultAmountFrom is Property. A reference can be any fully qualified property reference from any page, but if the property reference is not dot qualified, then it assumes the property will be found on the top level of the work object page. Specifies an actual amount number value if Default Amount From is Literal. Do not use quotes, $, or commas (that is, specify 1000.00 and not $1,000,00 or $1000.00 or “1000.00”). |

| Default Currency | The default currency for the transaction. |

| Protect Amount? | If this field is selected, the user interface does not allow input in the Amount field during manual accounting creation. If this field is not selected, users can modify this value during manual accounting creation. |

| Default Value Date From | Specifies the value date for the From account. |

| ValueDate FromValue | Specifies the value date for the From value. |

| Protect ValueDate? | If this field is selected, the user interface does not allow input in the Value date field during manual accounting creation. If this field is not selected, users can modify the value date during manual account creation. |

| PegaCommBankCorrTab | |

| Party Role | A unique string identifier for each transaction in this step. Its value is placed into a property named Role in the transaction step and may be used to find or report on the transaction. |

| Stream Name | Specifies the name of the stream to be used with this transactions. |

| Correspondence Language | Specifies the language to be used for any correspondence (documents) generated for this transaction. |

| Correspondence Type | Specifies the type of correspondence (documents) to be generated for this transaction. |

| Document Required? | Specifies if documents are required to complete this transaction. |

| Security Tab | |

| Name | Optional. Enter the name(s) of any named privileges where access to the privilege allows this step to be executed. |

| Field | Description |

| Class | Optional. Enter the class of privileges you specify in this window. |

| When Name | Optional. Enter a When rule that must evaluate to true to allow this step to be executed. Most step rules in the Smart Investigate for Payments product use When rules to allow access to the step only if the Party Role referenced in the step exists in the work object. |

| History Tab | Required. Full description of the instance and information on its usage. |

Previous topic Naming conventions Next topic Setting up accounting verification levels