Rating engine for healthcare plan rates

Sales Automation for Healthcare calculates rates for small group, large group, and individual healthcare coverage in order to demonstrate realistic member, subscriber, and group-level rates for plan quotes.

To configure detailed rating algorithms that leverage other rating parameters and tables, or to use external rating algorithms, a Lead System Architect can extend the application-provided rating calculations.

Pega Sales Automation for Healthcare includes the following rating capabilities:

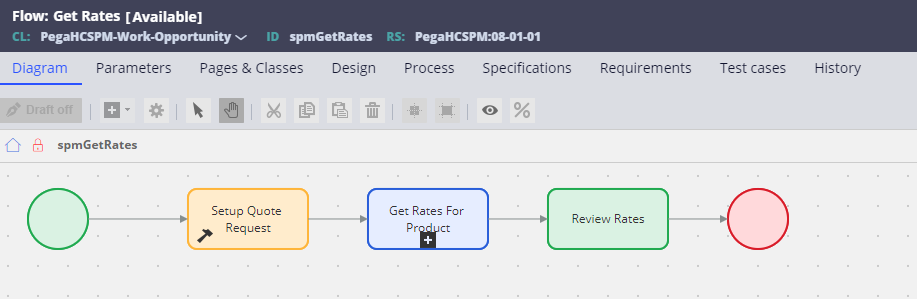

Rating engine flows

When the operator proceeds from the Plan selection screen and has at least one plan (product) selected in the shopping cart, thespmGetRates flow that is defined in the PegaHCSPM-Work-Opportunity class is invoked.

Rating data transform

The GetSampleRates data transform is defined in several classes:

- PegaHCSPM-Work-QuoteRequest

- PegaHCSPM-Work-QuoteRequest-SG

- PegaHCSPM-Work-QuoteRequest-LG

- PegaHCSPM-Work-QuoteRequest-Ind

Dynamic class referencing invokes the data transform from an appropriate class based on the end-user market segment selection for the quote request.

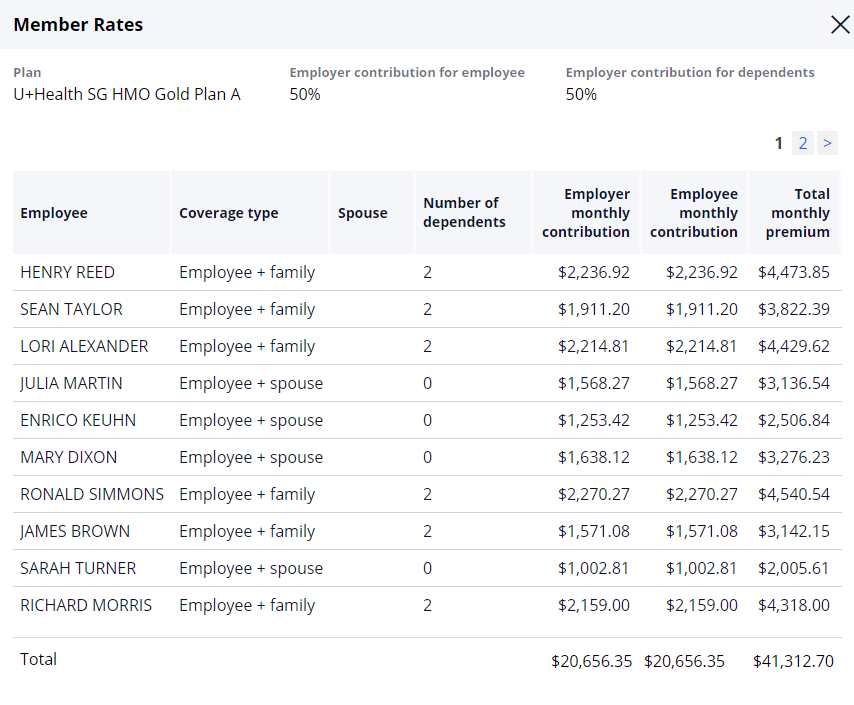

Rates display grid

When the user opens the quote request from the Quotestab of the opportunity, the composite rates for the group display for every selected plan.

The subscriber and member-level rate breakout are visible when the operator clicks the plan name link.

Rate calculations

Rates are calculated for every selected plan on the quote request and for every member on the census. The rates are aggregated based on employer contribution factors and tier levels. While the application might not include every conceivable rating factor, you can extend and configure this logic so that additional rating factors, such as region, group size, Standard Industrial Classification (SIC) code, and tobacco usage, can be considered.

- Member-level rate calculation

- Age factor

- Subscriber-level rate calculation

- Employer contribution

- Example: Group-level composite rate calculation

Member-level rate calculation

The Member-level rate calculation determines the age-adjusted rate for every individual who is quoted on the census. For example, the base rate for the selected plan is $500.

Example Plan Base Rate = 500

Member Base Rate = 500 x age factor for every member

The MemberBaseRateis the same as the Age Adjusted Member Rate because there are no other factors used in the calculation. The MemberBaseRate could have additional factors that are included in this calculation.

Employee number | Last name | Member type | Age | Base rate | Age adjusted member rate |

|---|---|---|---|---|---|

1 | One | Subscriber | 52 | 500 | 976.00 |

2 | Two | Subscriber | 48 | 500 | 817.50 |

2 | Two | Spouse | 44 | 500 | 698.50 |

3 | Three | Subscriber | 58 | 500 | 1,274.00 |

3 | Three | Dependent | 21 | 500 | 500.00 |

3 | Three | Dependent | 18 | 500 | 317.50 |

4 | Four | Subscriber | 45 | 500 | 722.00 |

4 | Four | Spouse | 42 | 500 | 662.50 |

4 | Four | Dependent | 19 | 500 | 317.50 |

4 | Four | Dependent | 17 | 500 | 317.50 |

4 | Four | Dependent | 15 | 500 | 317.50 |

4 | Four | Dependent* | 13 | 500 | 0.00 |

Age factor

Pega Sales Automation for Healthcare stores the following age band factors in the Age Factor table. The Age Band Factor is used to calculate the Member’s Age Adjusted Rate for every plan. The table contains the following columns:

- Age (integer)

- Age factor (Number)

- Effective date (Date)

- End date (Date)

The following table shows the factors for each age. You can modify the values and adjust the effective and end dates for each row.

Age band | Factor |

|---|---|

<20 | 0.635 |

21 to 24 | 1.000 |

25 | 1.004 |

26 | 1.024 |

27 | 1.048 |

28 | 1.087 |

29 | 1.119 |

30 | 1.135 |

31 | 1.159 |

32 | 1.183 |

33 | 1.198 |

34 | 1.214 |

35 | 1.222 |

36 | 1.230 |

37 | 1.238 |

38 | 1.246 |

39 | 1.262 |

40 | 1.278 |

41 | 1.302 |

42 | 1.325 |

43 | 1.357 |

44 | 1.397 |

45 | 1.444 |

46 | 1.500 |

47 | 1.563 |

48 | 1.635 |

49 | 1.706 |

50 | 1.786 |

51 | 1.865 |

52 | 1.952 |

53 | 2.040 |

54 | 2.135 |

55 | 2.230 |

56 | 2.333 |

57 | 2.437 |

58 | 2.548 |

59 | 2.603 |

60 | 2.714 |

61 | 2.810 |

62 | 2.873 |

63 | 2.952 |

>64 | 3.000 |

Subscriber-level rate calculation

The SubscriberBaseRate is the sum of all rates for the employee and dependents of a family unit.

Employee number | Last name | Member type | Age | Base rate | Age adjusted member rate | Subscriber level rate |

|---|---|---|---|---|---|---|

1 | One | Subscriber | 52 | 500 | 976.00 | 976.00 |

2 | Two | Subscriber | 48 | 500 | 817.50 | 1,516.00 |

2 | Two | Spouse | 44 | 500 | 698.50 | |

3 | Three | Subscriber | 58 | 500 | 1,274.00 | 2,091.50 |

3 | Three | Dependent | 21 | 500 | 500.00 | |

3 | Three | Dependent | 18 | 500 | 317.50 | |

4 | Four | Subscriber | 45 | 500 | 722.00 | 2,337.0 |

4 | Four | Spouse | 42 | 500 | 662.50 | |

4 | Four | Dependent | 19 | 500 | 317.50 | |

4 | Four | Dependent | 17 | 500 | 317.50 | |

4 | Four | Dependent | 15 | 500 | 317.50 | |

4 | Four | Dependent* | 13 | 500 | 0.00 |

Employer contribution

Pega Sales Automation for Healthcare includes the ability to capture the employer’s contribution towards covering the employee’s premiums. There are two contribution percentage parameters available in the Opportunity Application stage:

- Employer contribution towards Employee Only coverage type

- Employer contribution towards all other coverage types (Employee + Spouse, Employee + Child, Family)

Both of these parameters are optional, but the values entered are used to calculate the employer and employee components of the premium.

The following example illustrates the employer’s contribution:

- Employer contribution toward employee Only coverage = 50% (Employee 1 qualifies for this)

- Employer contribution toward all other coverage types (Dependent %) = 33% (Employees 2, 3, and 4 qualify for this)

|

|

|

|

|

|

SUBSCRIBER LEVEL RATE | ||

Employee | Last | Member | Age | Base | Age Adjusted | Subscriber Level Rate | Employer Portion | Employee Portion |

1 | One | Subscriber | 52 | 500 | 976.00 | 976.00 | 488.00 | 488.00 |

2 | Two | Subscriber | 48 | 500 | 817.50 | 1,516.00 | 500.28 | 1,015.72 |

2 | Two | Spouse | 44 | 500 | 698.50 | |||

3 | Three | Subscriber | 58 | 500 | 1,274.00 | 2,091.50 | 690.20 | 1,401.31 |

3 | Three | Dependent | 21 | 500 | 500.00 | |||

3 | Three | Dependent | 18 | 500 | 317.50 | |||

4 | Four | Subscriber | 45 | 500 | 722.00 | 2,337.0 | 771.21 | 1,565.79 |

4 | Four | Spouse | 42 | 500 | 662.50 | |||

4 | Four | Dependent | 19 | 500 | 317.50 | |||

4 | Four | Dependent | 17 | 500 | 317.50 | |||

4 | Four | Dependent | 15 | 500 | 317.50 | |||

4 | Four | Dependent* | 13 | 500 | 0.00 | |||

|

|

|

|

| 6,920.50 | 6,920.50 | 2,449.69 | 4,470.82 |

Group-level composite rate calculation

The Composite (Average) 4-Tier rates for the group for the selected plan is calculated by using a Rate Tier Factor table that specifies the rate tier for each coverage type.

The following values are used as rate tier factors for the 4-tier rate calculation for each coverage type.

Coverage Type Rate Tier Factor

Employee Only 1.0

Employee + Spouse 2.0

Employee + Child 1.8

Family 3.0

Rate tier factor table

- Tier (Number)

- Coverage Type (Text)

- Rate Tier Factor (Number)

- Effective Date (Date)

- End Date (Date)

The following steps illustrate the example calculation.

Step 1 – Calculate the Total Quote Units on the Census

Sum of the rate tier factors for each Employee unit in the census based on the coverage type.

Employee Number | Coverage Type | Rate Tier Factor |

|---|---|---|

1 | Emp | 1 |

2 | Emp + SP | 2 |

3 | Emp + Child | 1.8 |

4 | Family | 3 |

Total Quote Units | 7.8 | |

Step 2 – Sum the Total Employee Portion of the Monthly Premium

|

SUBSCRIBER LEVEL RATE | |||||||

Employee | Last | Member | Age | Base | Age Adjusted | Subscriber Level Rate | Employer Portion | Employee Portion |

1 | One | Subscriber | 52 | 500 | 976.00 | 976.00 | 488.00 | 488.00 |

2 | Two | Subscriber | 48 | 500 | 817.50 | 1,516.00 | 500.28 | 1,015.72 |

2 | Two | Spouse | 44 | 500 | 698.50 | |||

3 | Three | Subscriber | 58 | 500 | 1,274.00 | 2,091.50 | 690.20 | 1,401.31 |

3 | Three | Dependent | 21 | 500 | 500.00 | |||

3 | Three | Dependent | 18 | 500 | 317.50 | |||

4 | Four | Subscriber | 45 | 500 | 722.00 | 2,337.0 | 771.21 | 1,565.79 |

4 | Four | Spouse | 42 | 500 | 662.50 | |||

4 | Four | Dependent | 19 | 500 | 317.50 | |||

4 | Four | Dependent | 17 | 500 | 317.50 | |||

4 | Four | Dependent | 15 | 500 | 317.50 | |||

4 | Four | Dependent* | 13 | 500 | 0.00 | |||

6,920.50 | 6,920.50 | 2,449.69 | 4,470.82 | |||||

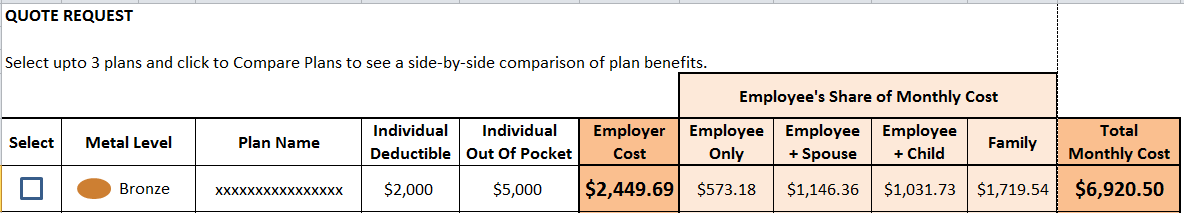

Step 3 – Calculate the Composite Employee Only Rate

Divide the Total Employee Portion of the Monthly Premium by the Total Quote Units to arrive at the Composite (Average) Employee Only Rate.

Total Employee Premium 4470.82

Total Quote Units / 7.8

Composite Employee Only Rate = 573.18

Step 4 – Calculate the Composite Employee Contribution Rates for Other Coverage Types

Calculate the employee contribution rates for the other coverage types by multiplying the employee only composite rate by the specific rate tier factor.

Composite Employee Only Rate = 573.18

Composite Employee + Spouse Rate = 573.18 x 2 = 1146.36

Composite Employee + Child Rate = 573.18 x 1.8 = 1031.73

Composite Family Rate = 573.18 x 3 = 1719.54

The following example shows how the preceding values map to the Composite Rate Grid for the selected plan.

Key business rules

Pega Sales Automation for Healthcare includes the following key business rules to calculate the rates. You can extended and maintain these rules in the implementation layer.

Name | Class | Type | Description |

|---|---|---|---|

getMemberRate | PegaHC-Data-Party-Member | Data Transform | This data transform calculates the member rate. Member rate = Base rate x Age factor x Tobacco factor x Region factor x Group size factor |

GetSampleRegionFactor | PegaHCSPM-Work-Quote | Decision Table | This decision table returns the Region Factor based on the combination of plan type, state, county, rating area, and postal code. |

GetSampleGroupSizeFactor | PegaHCSPM-Work-Quote | Decision Table | This decision table provides any discounted price if the opportunity has a specific number of eligible census (employees). Pega Sales Automation for Healthcare is configured to return 1 (or 100%) for all the values. If applicable, update this value to match realistic group size discounts. |

GetSampleAgeFactor | PegaHC-Data-Party-Member | Decision Table | This decision table provides discounted or boosted price based on age. Pega Sales Automation for Healthcare is configured to use age factor for medical plans only. Refer to Data Transform PegaHC-Data-Party-Member spmApplyStaticRatingFactors for the plan type separation logic. |

GetSampleTobaccoFactor | PegaHC-Data-Party-Member | Decision Table | This decision table returns Tobacco Factor. This decision table gives the boosted price based on age if tobacco is used in last 6 months. The option to select tobacco usage is available in both the initial and final census for an Individual opportunity. Pega Sales Automation for Healthcare is configured to use the tobacco factor only for Individual market segment. However, you can configure and extend that factor for other market segments, such as Small Group, Large Group, and Medicare. Refer to Data Transform PegaHC-Data-Party-Member ID spmApplyStaticRatingFactors for the market segment separation logic. |

SIC factor table | PegaHC-Data-SICFactor | Data Table | Standard Industry Codes (SIC) factor default value is 1 for Individual, and it is calculated based on the SIC code available in the account. Access the SIC factor table from the underwriter portal. |

Zip codes table | PegaHC-Data-ZipCode | Data Table | The zip codes table maintains zip codes, city, county code, county name, rating area and state names. During the quote request process, the system compares the zip codes in this table and finds the matching rating area and county details. After a matching rating area and county is found, the system pulls the matching plans from the plan rating area table. The zip codes table can be accessed from Dev Studio explorer panel (Data types-> Postal (zip) codes data type rule). |

Coverage codes table | PegaHC-Data-CoverageCode | Data Table | The coverage codes table is provided to maintain coverage areas where the plans are going to be sold. The Coverage codes table includes state, county, rating area, market segment, and effective dates. The Coverage codes table can be accessed from the Underwriter portal. |

Plan Rating table | PegaHC-Data-PlanRatingArea | Data Table | The Plan rating area table is provided to configure plan-specific values for different rating areas within the state and county. The effective and end dates can be specified for the plans, so that the dates are available in quote requests within this date range. During the quote request process, the system finds the matching plan entry for the given state and zip code in the quote request. Plans that meet these criteria are available in the plan selection screen. Access the Plan rating area table from the underwriter portal. |

Previous topic Plan guardrails API for Pega Sales Automation for Healthcare