On-Us acquirer routing

The On-Us business routing decision includes business rules driven for the Acquirer to process claims and disputes for Visa and Mastercard.

When a dispute is eligible for On-US Acquirer processing, and after submitting the details on the Reason code view, the case routes to On-Us Acquirer processing assignment to the Acquirer work queue.

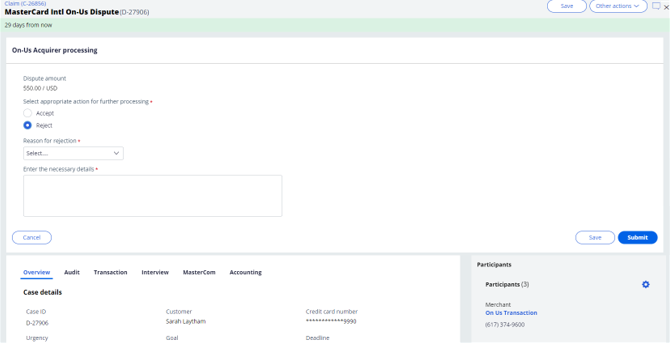

On the On-Us Acquirer processing view, the Acquirer review the dispute amount and select any of the following actions to process further.

- Accept

- Reject

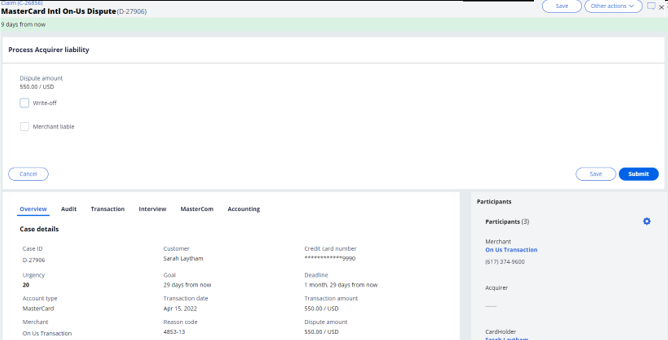

If the response is Accept, the case routes to the Process Acquirer liability screen where the Acquirer can select either of the following options to process further:

- Write-off - The case is resolved as Resolved-Write-off by sending final credit correspondence to the customer and respective accounting so the amount is debited from the Write-off account and credited to the Acquirer clearing account.

- Merchant liable - The case is resolved as Resolved-MerchantLiable by sending merchant resolution correspondence and respective accounting so that amount is debited from merchant account and credited to the Acquirer clearing account.

If Acquirer selects both Write-off and Merchant liable, the case is resolved as Resolved-SplitLiable by sending correspondence to the customer and respective accounting.

If the response is Reject, the Acquirer needs to select appropriate reason from the Reason for rejection drop-down list and enter the necessary details as shown in the following figure:

Once all the details are submitted, the case routes to the Process Acquirer response view.

Previous topic On-us processing Next topic Technical overview