CRS questionnaire in Due Diligence stage

The CRS questionnaire is encapsulated in a KYC Type available in Due Diligence stage.

For a customer being an individual, the questionnaire is composed only of two item groups:

- CRS status

- Self-Certification form

For a customer being an entity, the questionnaire is composed of three item groups:

- CRS status

- Classification based on available information

- Self-Certification form

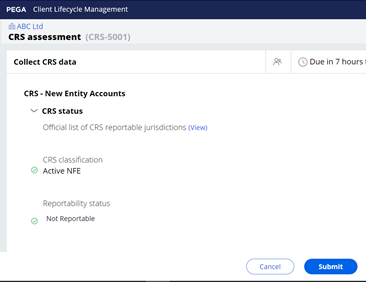

‘CRS status’ is pre-populated based on the input of the other two item groups – hence it is read-only – and it provides the user with the overview of the outcome of the CRS analysis, which is often used for reporting purposes.

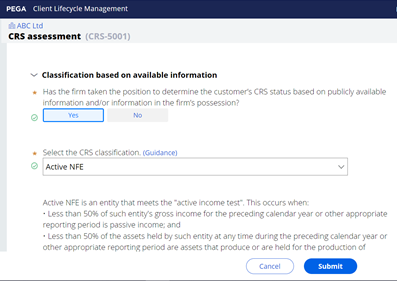

‘Classification based on available information’ is where the user can indicate the CRS classification whenever it is possible not to collect the relevant tax form from the customer.

‘Self-Certification form’ is where the user registers the relevant CRS classification of the customer on the back of the form received.

If the customer is an individual, then the user enters the customer’s tax residence country/ies and Tax Identification Number (TIN) or equivalent number.

If the customer is an entity, only when the CRS classification entered is either “Passive NFE” or “Professionally Managed Investment Entity in a non-CRS participating jurisdiction”, then additional mandatory fields get displayed to capture:

- The tax residence country/ies and TIN or equivalent number of the customer.

The identification details of the customer’s Controlling person(s) as well as their tax residence country/ies and TIN or equivalent number. “Controlling Person” means the natural person who exercises control over the customer.

Previous topic Regulatory details in Enrich stage Next topic FATCA