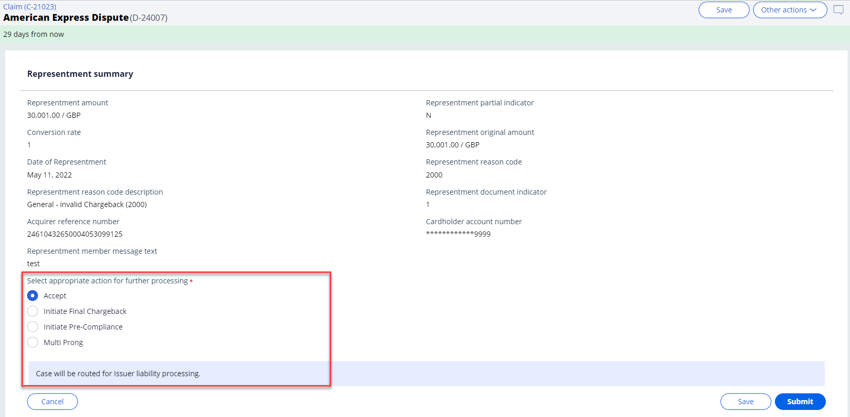

Representment acceptance

When the Issuer selects Accept as a Representment action at the Representment summary screen, a message “Case will be routed for Issuer liability processing” is displayed. On submitting the details, the case routes to the Process Issuer liability screen for further processing.

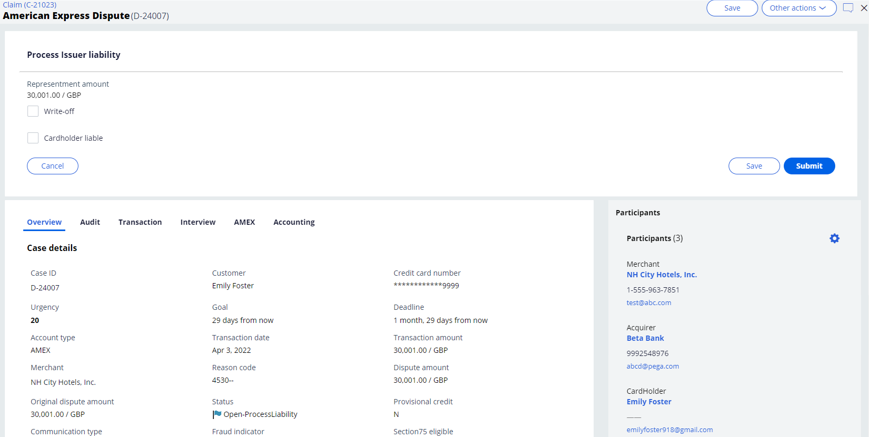

At the Process Issuer liability screen, the Issuer can review the Representment amount and can select either or both of the following options to resolve the case.

- Write-off

- Cardholder liable

In the case of Write-off, the case resolves as “Resolved-Write-off” by sending Final credit correspondence to the customer and initiating the accounting to credit the customer and debit the write-off account if credit has not been given previously. If the customer has received provisional credit that has not been reversed, the customer is informed that their provisional credit is now final, and no further accounting is needed.

In the case of Cardholder liable, the case resolves as “Resolved-CardholderLiable” by sending the "Customer liable resolution" correspondence and respective accounting. The system then checks to see if the customer has previously a credit that has not been reversed. If so, the amount is debited from the Cardholder account and credited to the receivable account. If the customer has not received any credit, no accounting will occur.

If both the options are selected, the case is resolved as Resolved-SplitLiable by sending the corresponding correspondence to the customer, with appropriate accounting initiated.

Previous topic Processing inbound representment Next topic Representment multi prong