Processing inbound Pre-Compliance and Compliance

Users of Pega Smart Dispute for Issuer can record and respond to inbound pre-compliance and compliance received from the Issuer after submitting the first chargeback and final chargeback.

Once the Issuer submits the first chargeback, the case is resolved as Chargeback. The user can reopen the case and choose the "Receive Pre-Compliance Letter - Inbound" option if the Issuer receives pre-compliance from the acquirer in response to chargeback.

Once the final chargeback is submitted from the Issuer side, the case is resolved as Final Chargeback. The user can reopen the case and choose the "Receive Pre-Compliance Letter - Inbound" option if the Issuer receives pre-compliance from the Acquirer in response to the final chargeback.

Receive pre-compliance letter - inbound

If the user selects the “Receive Pre-Compliance Letter – Inbound” option as Reopen-Resolution, the case is moved to the Decide Pre-Compliance response screen where the user can enter Pre-Compliance amount and select the Issuer response from the following options:- Accept

- Accept partially

- Reject

If the Pre-Compliance amount is less than the Dispute amount, then the difference between the Dispute amount and the Pre-Compliance amount is considered as Acquirer liable amount.

If the Issuer response is Accept, then the user must select Write off or Cardholder liable, or a combination of liability actions by entering corresponding liability amounts for further processing. However, the total Issuer liability amount must not exceed the Pre-Compliance amount.

If the Issuer response is Accept partially, then the user enters the amount for which the bank is accepting liability. The user has to select Write off, Cardholder liable, or a combination of liability actions by entering corresponding liability amounts for further processing of the remainder. The total Issuer liability amount must not be greater than or equal to the accepted amount, and the accepted amount must not be greater than or equal to the Pre-Compliance amount. The outstanding amount (difference between the pre-compliance amount and accepted amount) will be carried forward as a dispute amount for further processing.

In case of Reject the case is resolved as Pre-Comp Rejected and resolved as SplitLiability in case of Accept Partial with an appropriate dispute amount. Also, the issuer can reopen the case if he gets compliance from the acquirer.

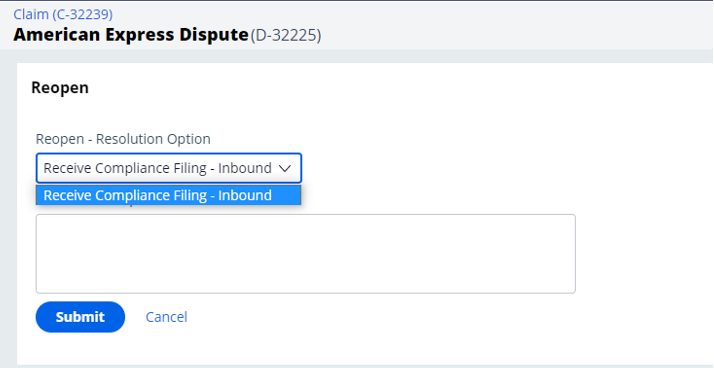

Receive compliance filing - inbound

If the Acquirer sends a Compliance filing to the Issuer, the user selects the "Receive Compliance Filing- Inbound" to reopen the case, The user is routed to the Record Compliance filing details screen where the user can enter the Compliance amount and select the Issuer response as either of the below options:

- Accept

- Reject

If the Compliance amount is less than the dispute amount, then the difference between the dispute amount and Compliance amount is added to the Acquirer liable amount.

If the Issuer response is Accept, then the user must select Write off or Cardholder liable, or a combination of liability actions by entering the corresponding liability amounts for further processing. The total Issuer liability amount must not exceed the Compliance amount.

In the Issuer response is Reject, the case will be routed to the Edit and send correspondence screen. Once the user submits the screen, the case will be moved to the Record association ruling screen where the user can record the association ruling from Merical Express and perform corresponding actions.

Previous topic American Express Overview Next topic Recording and processing inbound pre-compliance