Zelle fraud case workflow for when customers did not receive merchandise or service

Review the workflow of the Did Not Receive Merchandise (DNR) process in Zelle case type. The process describes the process to use when customers indicate that they might be the victim of a scam involving a promise of merchandise or service in exchange for funds, but never received what was promised. Because Zelle is not a transaction to purchase an item, Pega Smart Dispute for Issuer treats this scenario as a case of potential scamming or fraud.

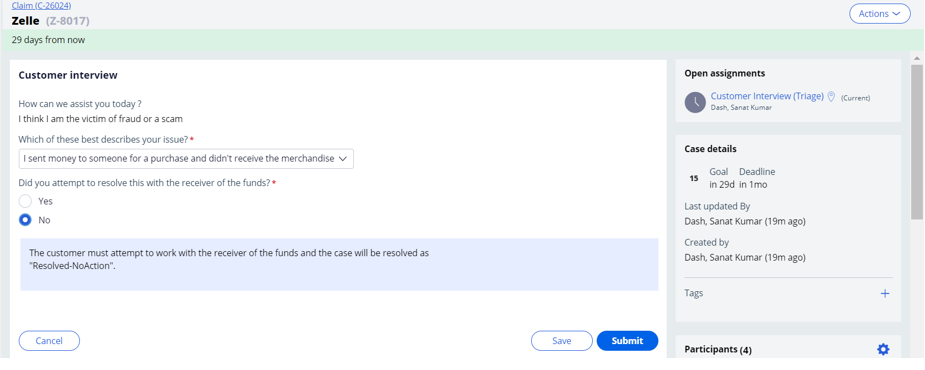

- In the Collect supplemental information view, if customer selects I think I am the victim of fraud or scam in the How can we assist you today? drop-down list, the customer receive a prompt to describe the issue in more detail, and then clicks Submit to proceed to the customer interview.

- On submission, the case automatically moves customers to the Customer interview view. Customers answer a series of questions that are extensible based on bank policy to identify possible fraud and determine the next action.

- When the customer selects I sent money to someone for a purchase and didn't receive the merchandise in the Which of these best describes your issue? drop-down list, the case proceeds with the Did Not Receive Merchandise scenario. The customer receives a series of questions that describes the case.

- If the customer responds with No to the Did

you attempt to resolve this with the receiver of the funds?

question, the CSR advises the customer to attempt to work with the

receiver of the funds and that case has a status of Resolved-No

Action. If the customer responds with

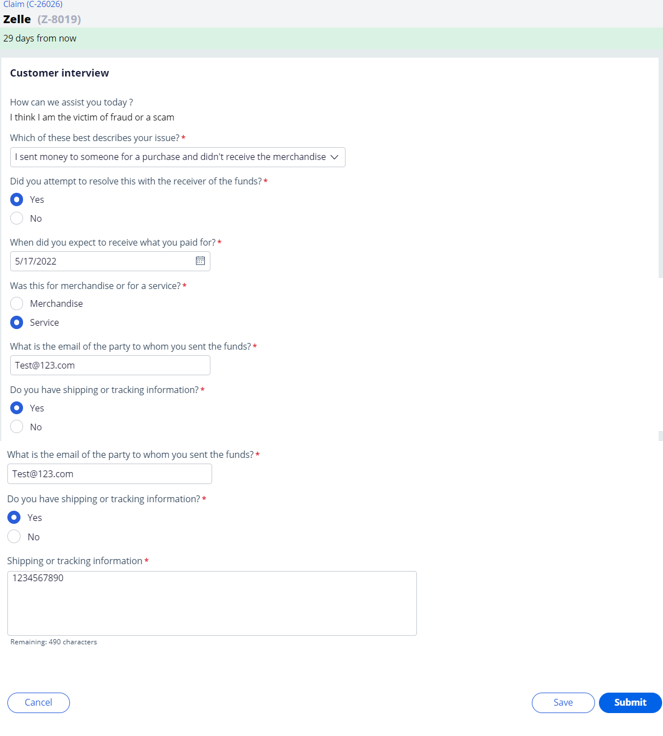

Yes, then the customer specifies the expected date to

receive funds, selects whether the issue is with merchandise or for a service,

and enters the email of the party to whom funds were sent.The following figure shows an example of the Customer interview view.

Customer Interview

- The customer is then asked whether shipping or tracking information is available. If the response is No, because the customer cannot provide any additional proof of sale, the customer is advised by the CSR that bank cannot proceed without shipping or tracking information to investigate the claim. The CSR move the case status toResolved-No Action.

- If the response is Yes, then the customer enters the

shipping or tracking information, and the case is submitted and routed to the

Zelle_Scam workbasket for additional

review.The following figure shows an example of the Customer interview view.

Customer Interview

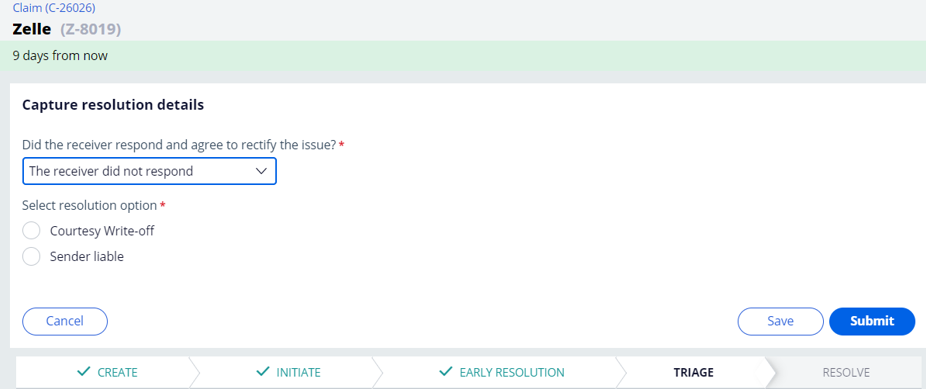

- The assignment in the back office is shipped a service-level-agreement of 10 business days during which customers can modify the request. After the 10 business days, the appropriate fraud investigative personnel might act further on the assignment based on the response that the investigator provides to the Did the receiver respond and agree to rectify the issue? question

- On the Capture resolution details view, if the fraud

investigator or appropriate personnel selects The receiver did not

respond as a response to the question, the following resolution

options are displayed:

- Courtesy Write-off

- The customer receives a courtesy write-off (Resolved-Courtesy Write-off).

- Sender liable

- The customer or initiating sender is deemed liable (Resolve-Sender Liable).

Organizations can modify or extend resolution options based on the policy of the bank.The following figure shows an example of the Capture resolution details view.Capture resolution details

- In the Capture resolution details view, if the fraud

investigator or appropriate personnel selects The receiver refused to

take any action as a response to the question, the following

resolution options are displayed:

- Courtesy Write-off

- The customer receives a courtesy write-off (Resolved-Courtesy Write-off).

- Sender liable

- The customer or initiating sender is deemed liable (Resolve-Sender Liable).

- On the Capture resolution details step, if the

fraud investigator or appropriate personnel selects The receiver

agreed to rectify the issue, the following actions to which the

receiver has agreed are available:

- Recipient refunds the sender through Zelle (Resolved-Refunded).

- Recipient delivers merchandise or service to the customer (Resolved-Corrected).

Previous topic Rules in the Zelle fraud path Next topic Technical overview