Zelle fraud path

Review the Zelle fraud or scam question workflow, which describes an overview of the process and the corresponding questionnaire. By becoming familiar with the workflow, users can more quickly process cases.

Collect Supplemental Information

- In the Collect supplemental information window, in the How can we assist you today? list, the customer selects I think I am the victim of fraud or scam, then describes the issue in detail and submits the form. The system then opens the Customer interview form.

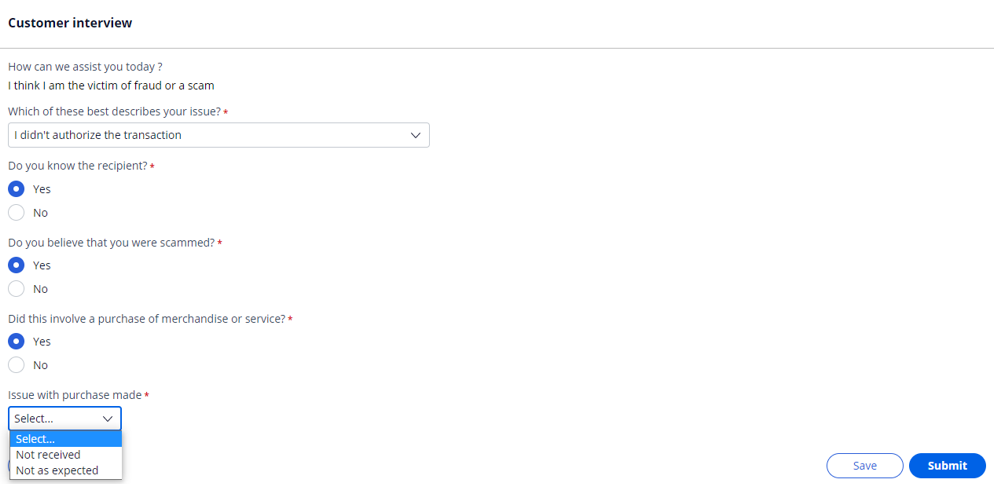

- In the Customer interview form, in the Which of the following best describes your issue? list, the customer selects I didn’t authorize the transaction and the system displays the corresponding questionnaire.

- If the customer selects Yes to the question Do you know the recipient?, the system then displays the Do you believe that you were scammed?question.

- If the customer response is Yes, the system displays the next question, Did this involve a purchase of merchandise or service?.

- If the customer response is Yes, then in the Issue

with purchase made dropdown list, the customer can select either

Not received or Not as

expected, as in the following figure:

The Issue with purchase made list on the Customer interview form

- If the customer selects No to the question Did this involve a purchase of merchandise or service?, the customer then needs to enter additional information to proceed further with the investigation.

- If the customer selects No to the question Do you believe that you were scammed?, the system displays the Capture resolution details window and the CSR has the option to resolve the case as either Courtesy write-off or Sender liable. This response can be extended or automated based on individual bank policy regarding courtesy write-offs.

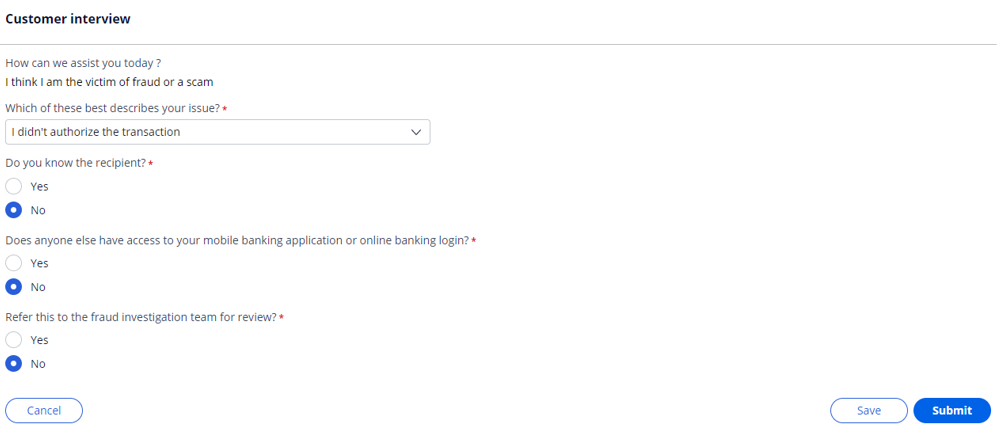

- If the customer selects No to the question Do you

know the recipient, the system displays the following questions

on the Customer interview form:

- Does anyone else have access to your mobile banking application or online banking login?

- Refer this to the fraud investigation team for review? (This question is for CSR use only. Individual banks can extend or automate this response based on their policy).

The Customer interview form

- If the customer selects No to the question Refer this to the fraud investigation team for review?, the system displays the Capture resolution details window, and the CSR has the option to resolve the case as either Courtesy write-off or Sender liable. This response can be extended or automated based on individual bank policy regarding courtesy write-offs.

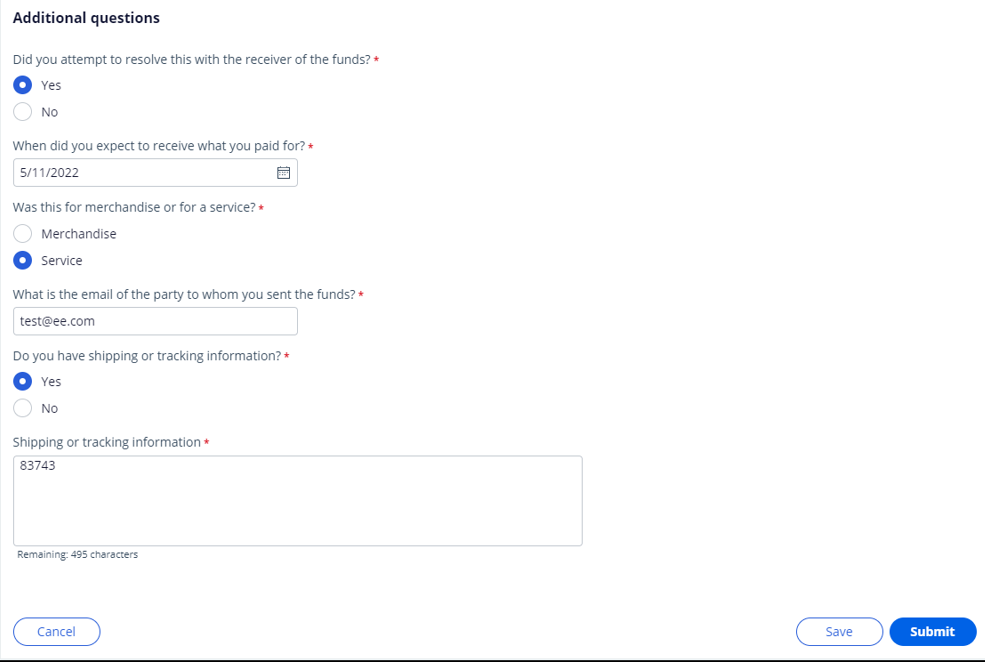

Additional questions

When the customer has indicated that their issue is based on a promise of merchandise or services in exchange for sending funds to a recipient, relevant options are presented in the Issue with purchase made list on the Customer interview details form. The system displays the corresponding questionnaire in the Additional questions window. These questions can be configured and extended based on individual bank policy.

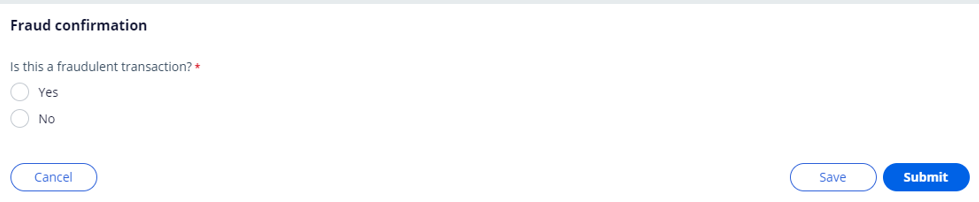

Fraud confirmation

After a review, the CSR is presented with the Refer this to the fraud investigation team for review? option.

When the customer selects No to the question Did this involve a purchase of merchandise or service?, the additional information must be provided first, before the option to refer the case to the fraud investigation team is presented. If the CSR believes that there is reason to proceed, the case is routed to the Zelle_Fraud workbasket for additional investigation.

When a fraud investigator or appropriate resource retrieves the case from the fraud workbasket, they review the information that was captured during the client conversation. If the investigator selects Yes to the question Is this a fraudulent transaction?, upon submission, the case is resolved as Resolved-Fraud with appropriate accounting. If the investigator selects No, then the case is routed to the Capture resolution stage, in which the fraud investigator can selectto resolve the case as either Courtesy write-off or Sender liable. This response can be extended or automated based on individual bank policy regarding courtesy write-offs. The following figure shows an example of the Fraud confirmation section:

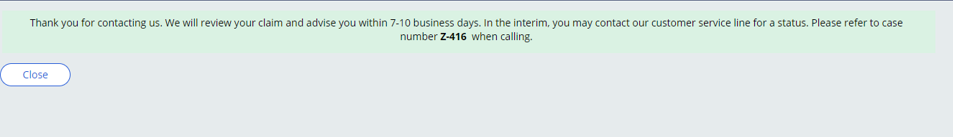

Confirmation notes

The following figure shows an example of the confirmation note that is displayed to the CSR when the case is routed to the Zelle_Fraud workbasket for fraud investigation. The text of the note can be changed to use bank-approved language, and the same confirmation note can be extended to web and mobile channels.

Capture resolution

When the user answers No to either the Refer this to the fraud investigation team for review? or Do you believe that you were scammed? on the Customer interview form, or if the CSR selects the No option in the Fraud Confirmation window, the system opens the Capture resolution details window, in which the CSR or investigator can select a resolution option. Based on the selection, the case is resolved as either Resolved-CourtesyWrite-off or Resolved-SenderLiable and the system displays the appropriate confirmation note. This can be extended or automated based on bank policy. The following figure shows the Capture resolution window:

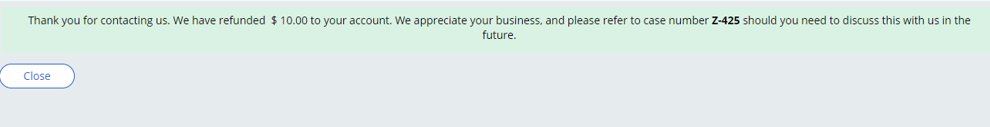

In the Capture resolution details window, the CSR has the option to resolve the case as Courtesy write-off, as in the following figure:

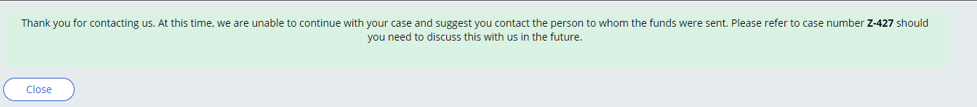

In the Capture resolution details window, the CSR also has the option to resolve the case as Sender liable, as in the following figure:

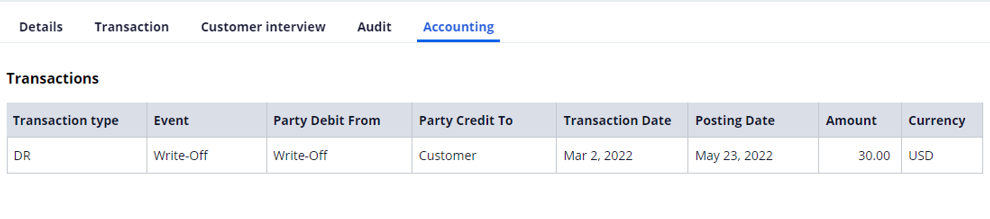

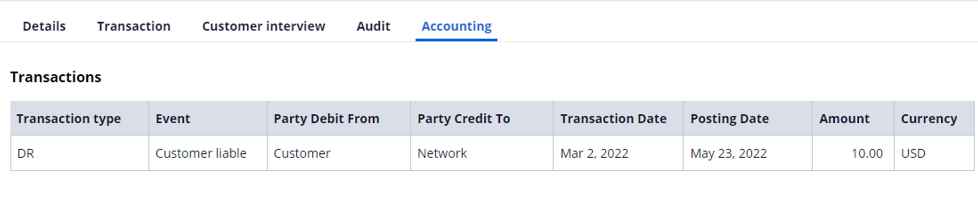

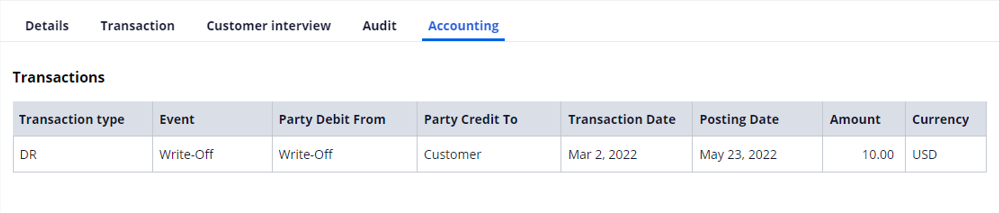

Accounting

The Accounting tab displays the transactions details based on the case resolved status.

If the investigator selects Yes to the question Is this a fraudulent transaction?, the case is resolved as Resolved-Fraud, as in the following figure:

If the CSR or investigator resolves the case as Resolved-SenderLiable, the system displays an appropriate confirmation note that can be extended or automated based on bank policy, as in the following figure:

If the CSR or investigator resolves the case as Resolved-CourtesyWrite-off, the system displays an appropriate confirmation note that can be extended or automated based on bank policy, as in the following figure:

Previous topic Rules in the Zelle case type Next topic Technical overview