Zelle fraud case workflow when the result is not as expected

Use the Not as Expected process when the customer indicates that they sent money to another individual for an item, but the recipient received not what they expected to receive. Because Zelle is not a means to pay for merchandise or services, the activity suggests that the customer might have been the victim of a scam, and these cases are managed by the CSR as potential fraud or scam activity.

In the Collect supplemental information view, in the How can we assist you today? dro-down list, the customer selects I think I am the victim of fraud or scam.

In Describe the complaint in detail box, the customer enters a detailed description of the issue, and then clicks Submit.

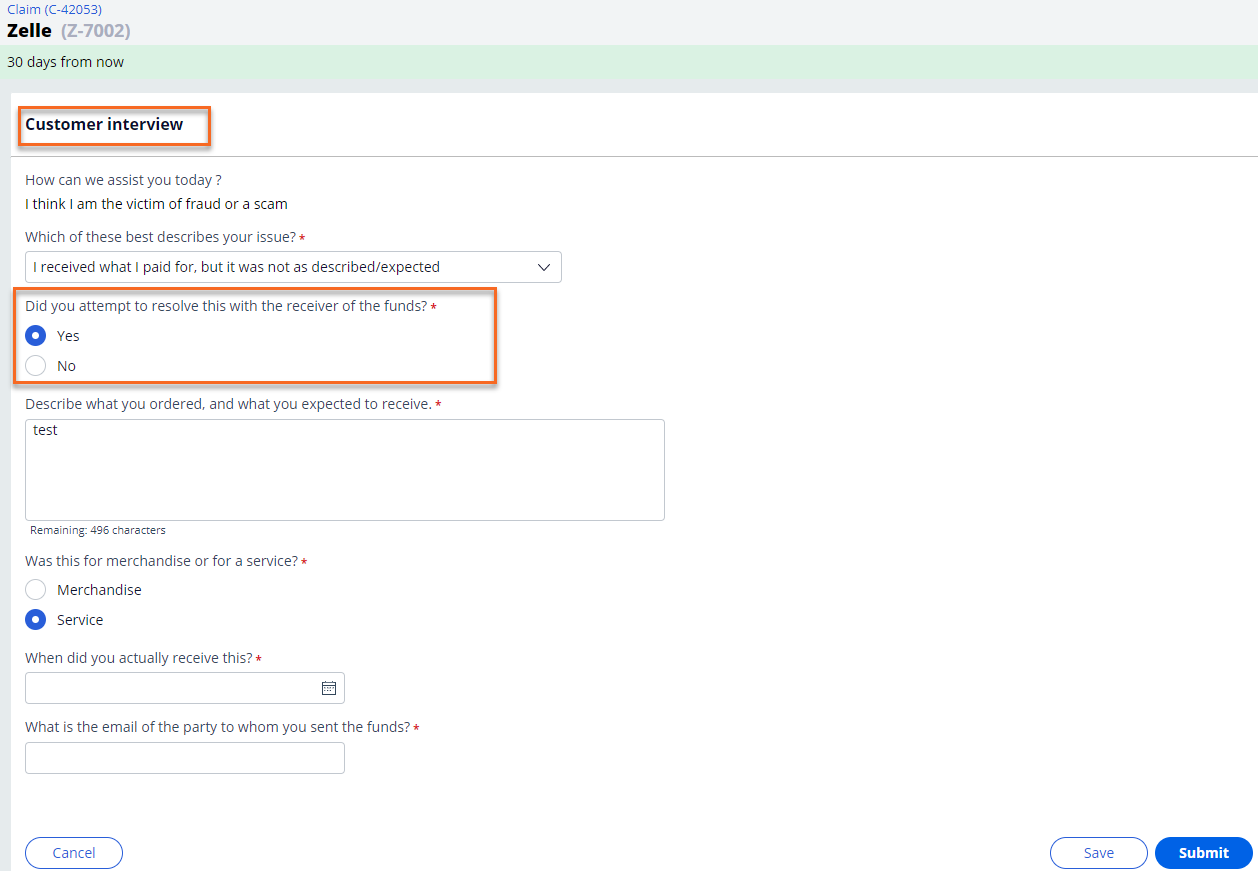

In the Customer interview view, the customer answers a series of questions to identify a possible fraud and determine the next action.

The list of questions can be extended based on your organization's policy.In the Which of these best describes your issue? list, the customer/CSR selects I received what I paid for, but it was not as described/expected, which starts the Not as Expected scenario.

The customer answers a series of questions that describe the case and help determine the resolution of the issue.

In the Did you attempt to resolve this with the receiver of the funds? question, the customer/CSR selects an option that describes any previous resolution attempts:

- To attempt to work with the receiver of the funds and resolve the case as Resolved-No Action, the customer selects No.

- To route the case from the CSR worklist to the

Zelle_Scam workbasket, the customer

selects Yes.

The customer then specifies the item they expected to receive, selects whether the issue is with merchandise or service, and enters the email of the party to whom funds to send the funds.

Customer interview view example

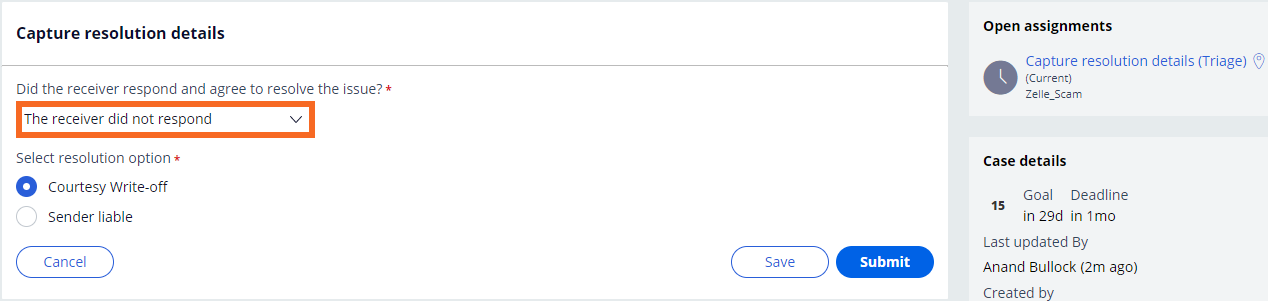

The assignment in the back office has a service level agreement (SLA) of ten business days. After this period, the fraud investigator or appropriate back office personnel have the option to to review the case and attempt to contact the receiver for resolution. They capture their results based in their answer to the question Did the receiver respond and agree to resolve the issue?

In the Capture resolution details view, the fraud investigator or back office worker selects, and then selects a resolution:

Capture resolution details view options

Selection Resolution options The receiver did not respond - Courtesy Write-off

- The customer receives a courtesy write-off from the bank (Resolved-Courtesy Write-off).

- Sender liable

- The bank holds the sender liable (Resolve-Sender Liable).

The receiver refused to take any action - Courtesy Write-off

- The customer receives a courtesy write-off from the bank (Resolved-Courtesy Write-off).

- Sender liable

- The bank holds the sender liable (Resolve-Sender Liable).

The receiver agreed to resolve the issue - The recipient refunds the sender through Zelle (Resolved-Refunded).

- The recipient delivers merchandise or service to the customer (Resolved-Corrected).

Capture resolution details view example

Click Submit.

Previous topic Rules for Zelle fraud case when customers did not receive merchandise or service Next topic Rules for the Zelle fraud case when the result is not as expected