Pega Sales Automation for Insurance artificial intelligence-based opportunity insights

Pega Sales Automation for Insurance uses decisioning capabilities to provide predictive insights for opportunities.

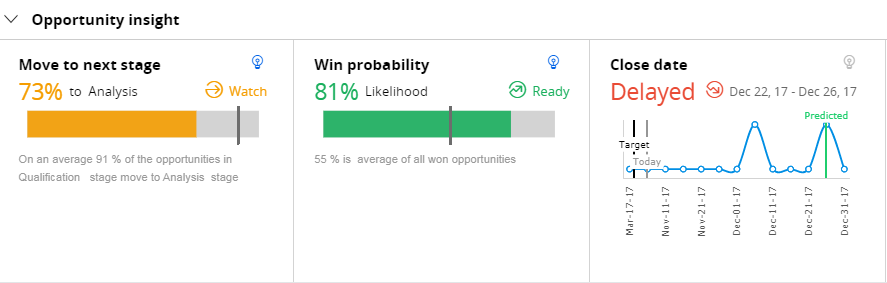

The application provides the following predictions:

- Probability to move to next stage

- Win probability

- Close date

Opportunity insights are displayed in the opportunity record for each opportunity. The widget is dynamic and responds to changes, such as stage changes and changes in customer activity or contact growth.

- Probability to move to next stage

- Adaptive models predict the likelihood that an opportunity will move from the current stage to the next stage. The application uses the average number of all opportunities that have moved from the current stage to the next stage as the base propensity. The difference between the likelihood that an opportunity will move and the base propensity is an indicator of how you are progressing with the opportunity.

- Win probability

- Adaptive models predict the likelihood of winning an opportunity. The application uses the average number of all won opportunities for a given stage as the base propensity. The difference between the likelihood that you will win an opportunity and the base propensity is an indicator of how you are progressing with the opportunity.

- Close date

- Adaptive models predict the quarter when an opportunity is most likely to close. The application compares the target date range that is set by the sales representative and the predicted closing quarter to indicate whether the opportunity close date is earlier than expected, on time, or delayed.

- The time frames for Pega Sales Automation for Insurance have been adjusted to reflect typical life cycles for business and individual insurance opportunities. The predicted close date ranges for individual opportunities are calculated in five-day increments or bands, and the x-axis increments displayed on the graph are ten days. The predicted close date ranges for business opportunities are calculated for ten-day increments, and the x-axis increments displayed are twenty days.

Historical data and adaptive learning

The application uses self-learning adaptive models to generate opportunity predictions. This approach is based on core decision management capabilities and provides the flexibility to add and remove predictors as your needs change.

- Historical data

- Pega Sales Automation for Insurance provides sample data for the initial training of the adaptive model.

- Adaptive learning

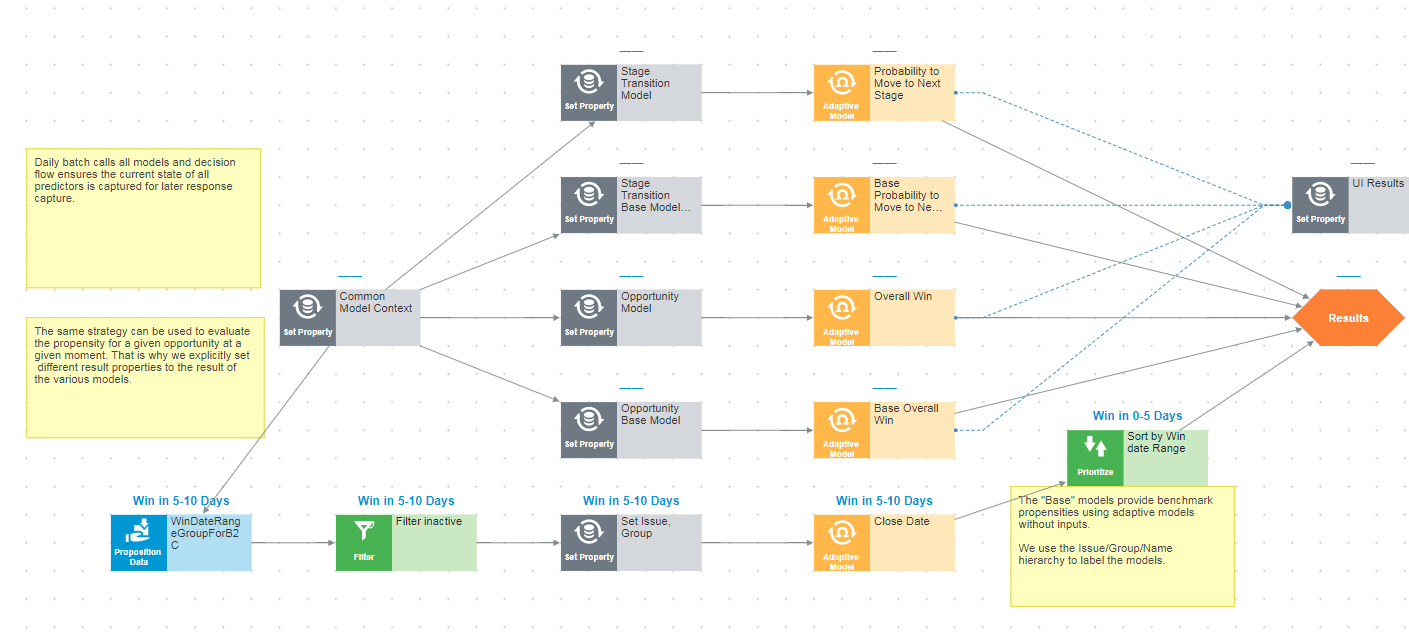

- An agent runs daily to execute a data flow that makes a call to a decision strategy. The decision strategy contains all of the adaptive models and runs on all of the open opportunities to capture the data that is required by the models. The decision strategy uses the standard Delayed Learning cache. When an opportunity is closed, the application triggers a response strategy from a data flow to fetch the data for relevant decisions and train the applicable models. You can use the same decision strategy at any time to evaluate an opportunity and return propensities.

Solution overview

The application uses a separate strategy (EvaluateOpportunity) for business and individual opportunities to drive the insights that are displayed in the Opportunity insights section of an opportunity record and to take daily predictor snapshots.

The strategy runs all three model types (move to next stage, opportunity win, and win date), distinguishing them by using labels that are mapped to the issue and group hierarchy. For the opportunity win and move to next stage models, the strategy also evaluates a model without predictors (opportunity win base propensities) to establish a base propensity for benchmarking.

The following figure displays the strategy flow for an individual opportunity:

The SnapshotAllOpportunities agent runs on a daily basis to take daily predictor snapshots. When an opportunity is closed, a strategy runs a capture response for all three models (move to next stage, opportunity win, and close date).

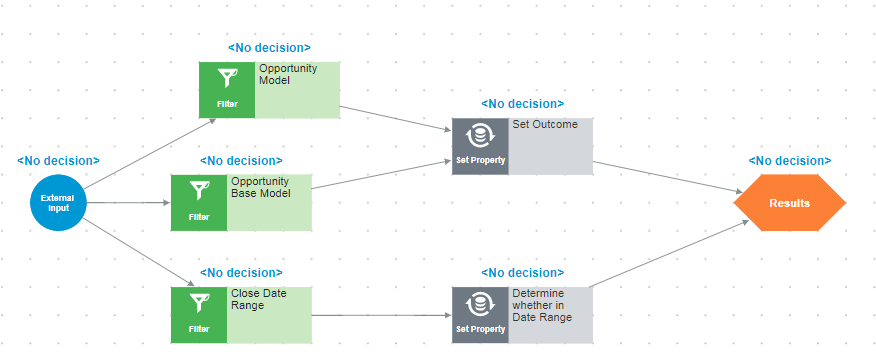

The following figure shows the HandleNextStageResponses capture response for the move to next stage model:

The following figure shows the ClosedOpportunity capture response for the opportunity win and close date models:

Strategy models

The solution includes a set of models that provide predictors based on historical data.

Move to next stage model

Prediction: Will this opportunity ever move to a higher stage?

The following list shows the predictors for the move to next stage model (for B2B and B2C opportunities):

- .StageDuration

- .ActiveDays

- .OpportunitySource

- .OrganizationIndustry

- .OrganizationRevenue

- .StageSequence

- .OpportunityAmount

Opportunity win model

Prediction: Will this opportunity ever be won?

The following table shows the predictors for the opportunity win model:

| B2B opportunity | B2C opportunity |

| .OpportunityAmount | .OpportunityAmount |

| .OpportunitySource | .OpportunitySource |

| .NumberOfDaysBeforeClose | .NumberOfDaysBeforeClose |

| .ActiveDays | .ActiveDays |

| .WinPercentForAnAgent | .WinPercentForAnAgent |

| .InternalQuotesCount | .InternalQuotesCount |

| .ExternalQuotesCount | .ExternalQuotesCount |

| .OrganizationIndustry | .PrimaryContact.Age |

| .OrganizationRevenue | .PrimaryContact.Gender |

| .StageSequence | .PrimaryContact.MaritalStatus |

| .PrimaryContact.HouseholdMemberRole | |

| .PrimaryContact.PolicyPremiumPaid | |

| .StageSequence |

Opportunity close date model

Prediction: What is the close date range for this opportunity based on today's opportunity data?

The following table shows the predictors for the opportunity close date model:

| B2B opportunity | B2C opportunity |

| .StageDuration | .StageDuration |

| .ActiveDays | .ActiveDays |

| .OpportunitySource | .OpportunitySource |

| .OrganizationIndustry | .OrganizationIndustry |

| .OrganizationRevenue | .OrganizationRevenue |

| .StageSequence | .StageSequence |

| .OpportunityAmount | .OpportunityAmount |

| .NumberOfDaysBeforeClose | .NumberOfDaysBeforeClose |

| .WinPercentForAnAgent | .WinPercentageForAnAgent |

| .ExternalQuotesCount | .ExternalQuotesCount |

| .Products(1).ProductID | .Products(1).ProductID |

| .InternalPolicyCount | .InternalPolicyCount |

| .IntQuoteCountPendingUW | .IntQuoteCountPendingUW |

| .IntQuoteCountPendingCustomer | .IntQuoteCountPendingCustomer |

| .IntQuoteCountAccepted | .IntQuoteCountAccepted |

| .IntQuoteCountRejected | .IntQuoteCountRejected |

| .Stage of Submission | .Stage of Submission |

| .QuoteSumbissionAge | .QuoteSumbissionAge |

| .PrimaryContact.Age | |

| .PrimaryContact.Gender | |

| .PrimaryContact.MaritalStatus | |

| .PrimaryContact.HouseholdMemberRole | |

| .PrimaryContact.PolicyPremiumPaid |

The opportunity close date model does not support exact date win predictions. Instead, ADM supports separate models for the outcomes shown in the following table:

| B2B opportunity | B2C opportunity |

| Will this opportunity be won in 0-10 days from now? | Will this opportunity be won in 0-5 days from now? |

| Will this opportunity be won in 10-20 days from now? | Will this opportunity be won in 5-10 days from now? |

| Will this opportunity be won in 20-30 days from now? | Will this opportunity be won in 10-15 days from now? |

| Will this opportunity be won in 30-40 days from now? | Will this opportunity be won in 15-20 days from now? |

| Will this opportunity be won in 40-50 days from now? | Will this opportunity be won in 20-25 days from now? |

| Will this opportunity be won in 50-60 days from now? | Will this opportunity be won in 25-30 days from now? |

| Will this opportunity be won in 60-70 days from now? | Will this opportunity be won in 30-35 days from now? |

| Will this opportunity be won in 70-80 days from now? | Will this opportunity be won in 35-40 days from now? |

| Will this opportunity be won in 80-90 days from now? | Will this opportunity be won in 40-45 days from now? |

| Will this opportunity be won in 90-100 days from now? | Will this opportunity be won in 45-50 days from now? |

| Will this opportunity be won in 100-110 days from now? | Will this opportunity be won in 50-55 days from now? |

| Will this opportunity be won in 110-120 days from now? | Will this opportunity be won in 55-60 days from now? |

Data pages

The solution uses the following data pages.

- D_PredictBusOpportunity

- Opportunity insights for business opportunities run in the context of the D_PredictBusOpportunity data page. This data page has the SAPredictOpportunity activity as a data source, which runs the SAPredictOpportunity data flow. The data flow uses the EvaluateOpportunity strategy to predict the propensity to move to the next stage, to win an opportunity, and to predict the close date range.

- D_PredictIndvOpportunity

- Opportunity insights for individual opportunities run in the context of the D_PredictIndvOpportunity data page. This data page has the SAPredictOpportunityForInd activity as a data source, which runs the SAPredictOpportunity data flow. The data flow uses the EvaluateOpportunity strategy to predict the propensity to move to the next stage, to win an opportunity, and to predict the close date range.

Data flows

The solution uses data flows listed in this section.

- SAPredictOpportunity for business opportunities

- The SAPredictOpportunity data flow calculates the value of the adaptive model predictors by using the SetB2BPredictorsForEvaluateOpp data transform, which sets predictor values from the opportunity and its related entities such as account, organization, and owner.

- The SAPredictOpportunity data flow reuses the EvaluateOpportunity strategy to get the analytic results for the business opportunity.

- SAPredictOpportunity for individual opportunities

- The SAPredictOpportunity data flow calculates value of the adaptive model predictors and sets predictor values for the opportunity by using the SetB2CPredictorsForEvaluateOpp data transform.

- The SAPredictOpportunity data flow reuses the EvaluateOpportunity strategy to get the analytic results for the individual opportunity.

- OpportunityClosed for business opportunity

- The OpportunityClosed data flow calls the CloseOpportunity strategy of the business opportunity, which captures responses for decisions in the past period. It captures responses for the business opportunity win model and the business opportunity close date model.

- OpportunityClosed for individual opportunity

- The OpportunityClosed data flow calls the CloseOpportunity strategy of the individual opportunity, which captures responses for decisions in the past period. It captures responses for the individual opportunity win model and the individual opportunity close date model.

- MovedToNextStage

- The MoveToNextStage data flow calls the HandleNextStageResponses strategy, which is the core strategy for training the PredictNextStage adaptive model. The available responses depend on whether an opportunity moves up or down from the current stage.

- SnapshotOneOpportunity

- Pega Sales Automation for Insurance has separate SnapshotOneOpportunity data flows for business and individual opportunities. The data flow reuses the EvaluateOpportunity strategy of the opportunity. This data flow runs on a daily basis by a background processing agent and captures all predictors for the opportunity each time it runs.

Viewing data flows

You can view details for each data flow in Dev Studio.

- In the Explorer pane of Dev Studio, click Records.

- Click .

- To open the data flow record, click a data flow name.

Viewing strategies

You can view details for each strategy in Dev Studio.

The solution uses the following strategies:

- EvaluateOpportunity

- HandleNextStageResponses

You can view details for each strategy in Dev Studio.

- In the Explorer pane of Designer Studio, click Records.

- Click .

- To open the strategy record, click a strategy name.

Adaptive models

Pega Sales Automation for Insurance uses the PegaInsCRM-Data-AI-Oppt-Predictors table (sai_predictors_oppt_insight) to store historical data for training the adaptive models.

Data flows to train adaptive models

The solution uses the following data flows to train the adaptive models:

- StoreBusinessOpportunitySnapshots

- The solution uses the StoreBusinessOpportunitySnapshots data flow during the initial training of the business opportunity models by using the data. This data flow filters business opportunities and converts each record from the PegaInsCRM-Data-AI-Oppt-Predictors class into business opportunity objects and then routes them to the EvaluateOpportunity strategy of the business opportunity class. In the data flow rule, the Mode for the EvaluateOpportunity strategy (decision strategy shape) is set to Make decision and store data for later response capture.

- StoreIndividualOpportunitySnapshots

- The solution uses the StoreIndividualOpportunitySnapshots data flow during the initial training of the individual opportunity models by using the data. This data flow filters individual opportunities and converts each record from the PegaInsCRM-Data-AI-Oppt-Predictors class into individual opportunity objects and then routes them to the EvaluateOpportunity strategy of the individual opportunity class. The Mode for the EvaluateOpportunity strategy is set to Make decision and store data for later response capture.

- TrainBusinessOppFromHistory

- The input for TrainBusinessOppFromHistory comes from the OpportunityStages report definition, which fetches one record per opportunity from the predictors’ data table, sorted by maximum stage. This data flow calls the TrainBusOpportunityClosed and MovedToNextStage data flows.

- TrainIndvOppFromHistory

- The input for TrainIndvOppFromHistory comes from the OpportunityStages report definition, which fetches one record per opportunity from the predictors’ data table, sorted by maximum stage. This data flow calls the TrainIndvOpportunityClosed and MovedToNextStage data flows.

- TrainBusOpportunityClosed

- The data flow calls the TrainBusOpportunityClosed strategy, which captures responses for decisions in the past period.

- TrainIndvOpportunityClosed

- The data flow calls the TrainIndvOpportunityClosed strategy, which captures responses for decisions in the past period.

Strategies to train adaptive models

The solution uses the following strategies to train the adaptive models:

- TrainIndvOpportunityClosed

- TrainBusOpportunityClosed

- HandleNextStageResponses

Previous topic Activating and training Pega Sales Automation for Insurance adaptive models for artificial intelligence Next topic Next best action in Pega Sales Automation for Insurance