Configuring the Calculate Customer Lifetime Value objective for retail banking

The Calculate Customer Lifetime Value objective allows you to define how customer lifetime value (CLV) is calculated in Pega Customer Decision Hub specifically for retail banking.

- Customer lifetime value (CLV)

- The CLV is the discounted value of the future profits that will be generated by an individual customer, discounted over a weighted average cost of capital. For example, a customer that will generate $120, $80, $30, $50, and $10 of profits in the next 5 years will have a CLV of $238, if the discounted factor is 10%.

In retail banking, CLV helps your organization reach strategic objectives, such as increasing share of wallet, improving customer retention, and increasing return on marketing investment.

By activating customer valuation models, you can place more emphasis on customer service and long-term retention, rather than on maximizing short-term sales. As these future profits are uncertain, models have to be developed to estimate the future value of customers and based on data analysis techniques instead of the traditional analysis of historical data.

To deliver a CLV in a retail banking context, use the Pega model for customer valuation based on research by Haenlein, Kaplan & Beeser, as shown in the following figure:

- In the Customer Lifetime Value method section, click Configure.

- In the Configure Calculation Method dialog box, select Retail Banking by clicking Add, and then Apply.

- In the Discount rate field, enter, for example,

10.WACC is the recommended discount rate.

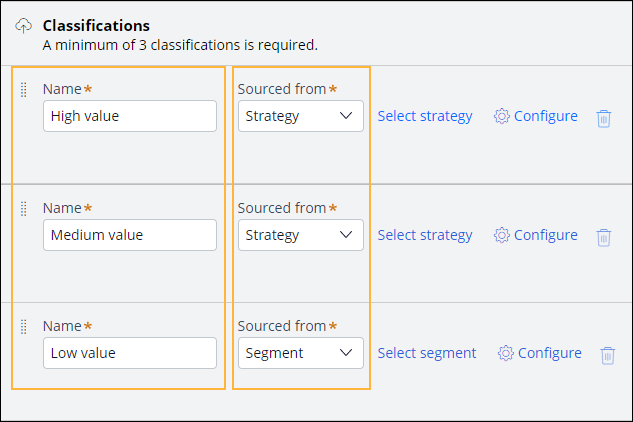

- In the Classifications section, add a minimum of three

classifications by clicking Add classification:

- Classifications

- Classifications are groupings of your customers according to a criterion. For example, you may group your customers as high value, medium value, and low value clients. The CLV calculation for retail banking supports a maximum of 20 classifications. Each classification can be represented as either a (sub)strategy or a segment.

- Classifications require the appropriate strategy rules to be created in advance. For more information on creating a strategy rule, see Using the Strategy Builder. For information about creating a segment, see Defining customer audiences with customer segments.

An example of customer classifications in retail banking

- In the Name field, enter a name of your classification, for example, High Value.

- In the Sourced from drop-down list, choose if you want each classification to be represented as a strategy or a segment.

- Optional: In the Classifications section, to choose a specific strategy or

a segment for your classification, click Select strategy or

Select segment:

- If you click Configure Strategy, in the Configure Strategy dialog box, select your strategy by clicking Add, and then Apply.

- If you click Configure Segment, in the Configure Segment dialog box, select your segment by clicking Add, and then Apply.

You can also create a strategy or a segment by clicking Create in the Configure Strategy or Configure Segment dialog box. For more information, see Creating strategies or Creating a Criteria Segment. - In the Classifications section, configure each classification by clicking Configure.

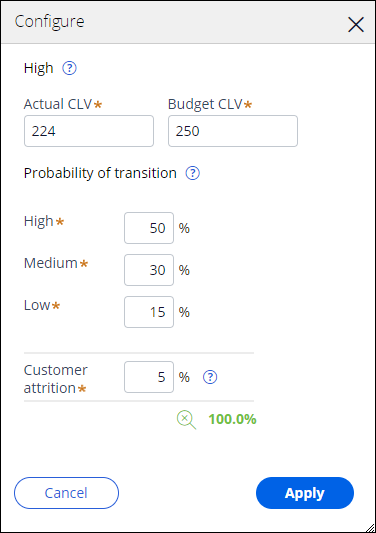

- In the Configure dialog box, fill in the required fields, as shown

in the following example, and then click Apply.

- On the top of the Create a Strategy page, click Save.

Calculate the CLV for retail banking by performing the following steps:

Previous topic Configuring the Calculate Customer Lifetime Value objective Next topic Configuring the Fixed or Dynamic Action Bundle objective